BNB, the native token of BNB Chain and widely used for transaction fee discounts on Binance, fell more than 2% in the last 24-hour period amid a surge in trading volume and as BNB Chain memecoin trading eases.

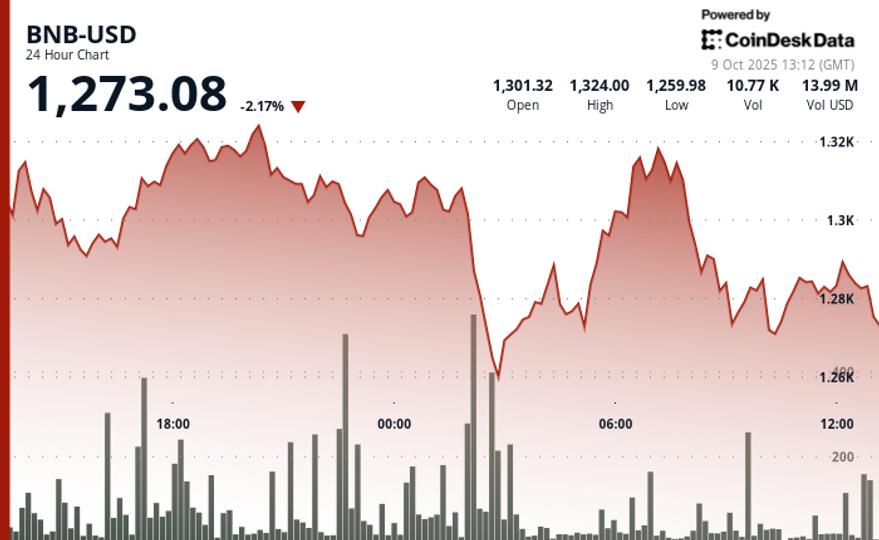

The token fell from $1,308 to a low of $1,255 early in the session, recovering to $1,270, where it is currently trading. The sell-off was met with large volume buying near the $1,255-$1,280 range, indicating potential institutional accumulation at lower prices, according to CoinDesk Research’s technical analysis model.

Despite a modest bounce, BNB struggled to reclaim key resistance near $1,320, leaving short-term bearish pressure intact.

This turbulence came as BNB Chain hit a record 5 trillion gas used in a single day, driven by 24 million swap transactions, representing 77% of total network activity, according to data from Dune.

A new standard gas fee of 0.05 Gwei, now adopted by key ecosystem partners such as Binance and Trust Wallet, has made on-chain trading cheaper and faster.

“The scale of the increase is hard to ignore and it’s easy to get caught up in the headline numbers. But what this really shows is that the community remains one of the strongest forces driving participation in blockchain,” Max Rabinovitch, chief strategy officer at Chiliz, told CoinDesk.

“Digital communities thrive on shared purposes and sentiments, whether it’s an internet subculture, a real-world sports club, or a specific utility. In the case of BNB, its growth reflects an active trading community that is deeply engaged.” added Rabinovitch. “Price movements aside, however, it is another reminder that the community remains the backbone of the digital asset space.”

It’s worth noting that BNB’s drop came after the token surged more than 45% in a month to become the third-largest cryptocurrency by market capitalization, behind only bitcoin and ether.

Growing business accumulation also influenced the rebound. CEA Industries revealed earlier this year that its BNB holdings increased to 480,000 tokens.

Disclaimer: Portions of this article were generated with the help of artificial intelligence tools and were reviewed by our editorial team to ensure accuracy and compliance with our standards. For more information, see CoinDesk’s full AI Policy.