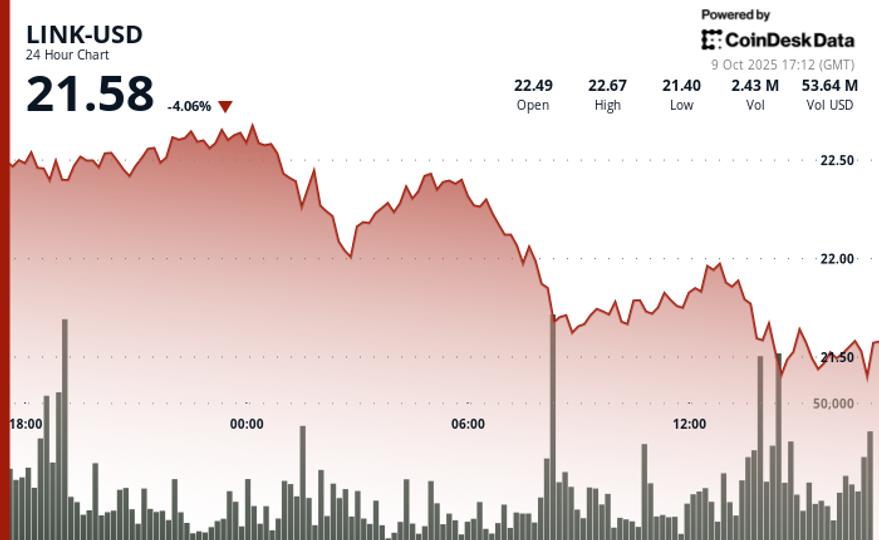

The native token of the Chainlink oracle network It faced significant institutional selling pressure during the 24-hour trading session, falling to its weakest price in over a week.

LINK fell 4% to a session low of $21.30, reversing more than 8% from Monday’s local high, CoinDesk data shows. The drop came in line with weakness in the broader crypto market. The CoinDesk 20 index, a benchmark for that broader market, was also down about the same amount.

Meanwhile, Chainlink Reserve, a facility that purchases tokens on the open market using revenue from protocol integrations and services, kept up its weekly habit, purchasing another 45,729 LINK worth nearly $1 million on Thursday. The reserve currently contains tokens worth almost $10 million.

However, Thursday’s drop meant the vehicle is now underwater and LINK is trading below the average cost basis of $22.44, the dashboard shows.

Key technical indicators

CoinDesk Research’s technical model signaled bearish momentum, underscoring weakening investor sentiment.

- The token’s trading range expanded to $1.05, representing 5% volatility between the session low of $21.53 and high of $22.68.

- Technical resistance materialized at the $22.68 level, where the token reversed course with an exceptionally high volume of 1,981,247 units.

- Additional resistance formed at the $21.92 level.

Disclaimer: Portions of this article were generated with the help of artificial intelligence tools and were reviewed by our editorial team to ensure accuracy and compliance. our standards. For more information, see CoinDesk’s full AI policy.