The native Aave token The largest decentralized crypto lending protocol, got caught in the middle of Friday’s cryptocurrency flash crash, while the protocol proved resilient in a historic liquidation cascade.

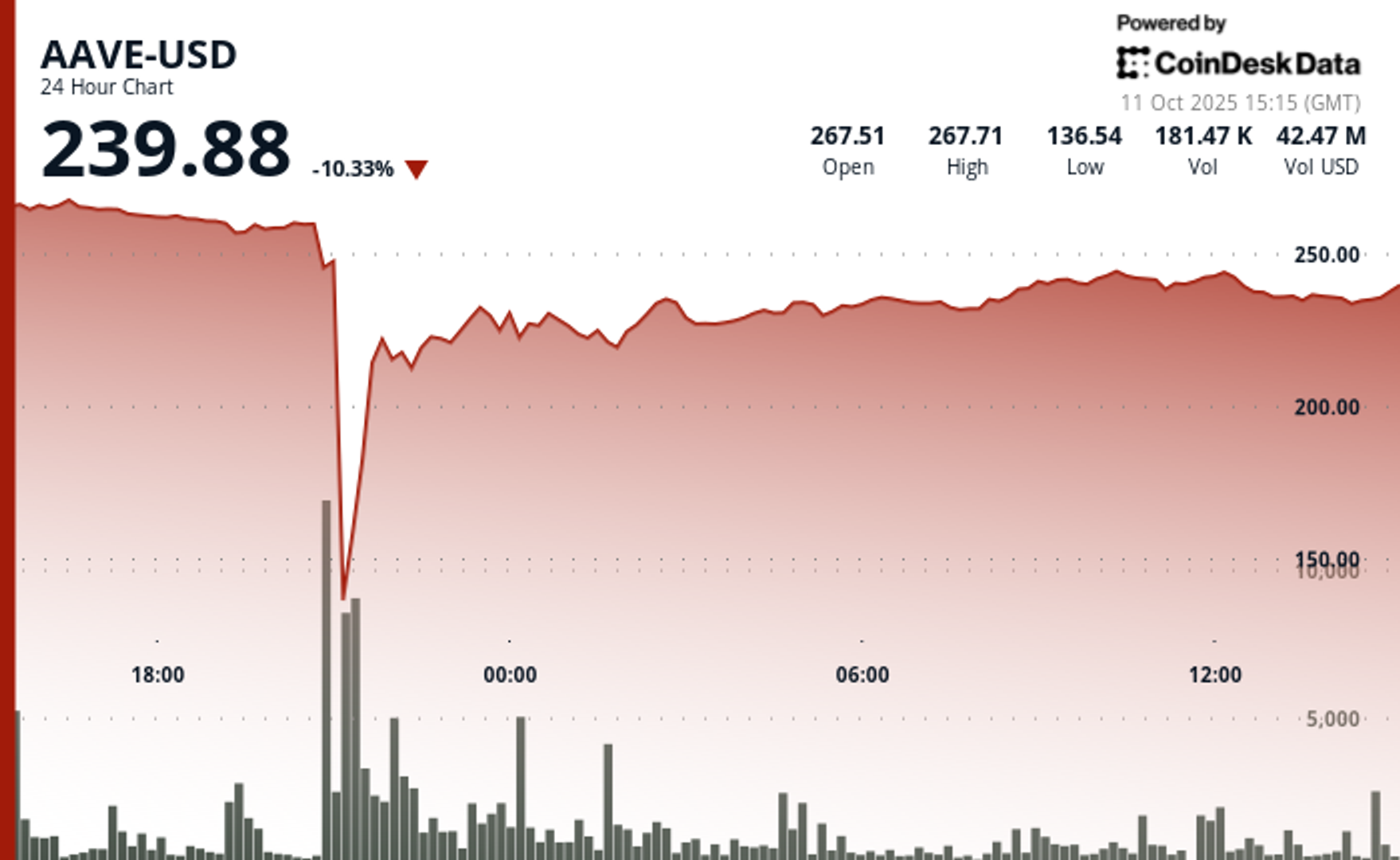

The token, which was trading at around $270 early on Friday, fell as much as 64% later in the session to touch $100, the lowest level in 14 months. It then staged a rapid rally to around $240, still down 10% in the last 24 hours.

Stani Kulechov, founder of Aave, described Friday’s event as the “biggest stress test” ever for the protocol and its $75 billion lending infrastructure.

The platform allows investors to lend and borrow digital assets without conventional intermediaries, using innovative mechanisms such as flash loans. Despite extreme volatility, Aave’s performance underscores the evolving maturity and resilience of DeFi markets.

“The protocol worked perfectly, automatically liquidating a record $180 million worth of collateral in just one hour, without any human intervention,” Kulechov said in a Friday X post. “Once again, Aave has proven its resilience.”

Key Price Action:

- AAVE suffered a dramatic flash crash on Friday, falling 64% from $278.27 to $100.18 before recovering to $240.09.

- The DeFi protocol demonstrated notable resilience with its native token rallying 140% from intraday lows, backed by a substantial trading volume of 570,838 units.

- Following the volatility, AAVE entered consolidation territory within a tight range of $237.71 to $242.80 as markets digested the dramatic price action.

Summary of technical indicators

- Price range of $179.12 representing 64% volatility over the 24-hour period.

- Volume increased to 570,838 units, substantially exceeding the average of 175,000.

- Short-term resistance was identified at $242.80 and limits the rebound during the consolidation phase.

Disclaimer: Portions of this article were generated with the help of artificial intelligence tools and were reviewed by our editorial team to ensure accuracy and compliance. our standards. For more information, see CoinDesk’s full AI policy.