XRP traded on the defensive but held key supports on Friday, recovering from an initial drop to $2.19 as institutional buyers absorbed selling pressure. The move came amid renewed tariff fears between the United States and China and cautious positioning ahead of next week’s SEC deadlines for XRP spot ETFs.

What to know

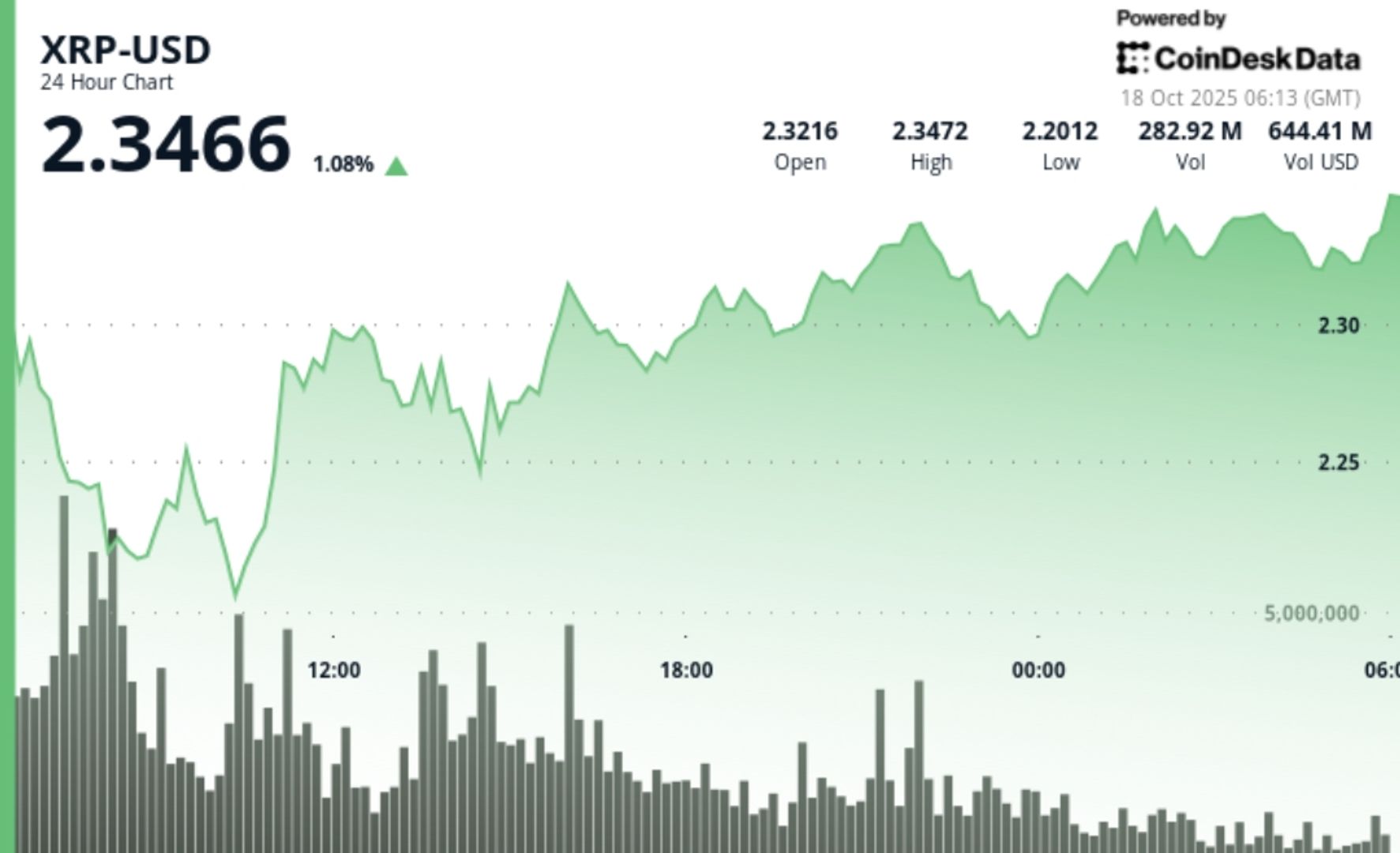

• XRP ranged between $2.19 and $2.35 during the 24-hour session from October 17 06:00 to October 18 05:00, a range of 7%.

• Trading volume reached 246.7 million during 7:00 a.m., almost triple the 24-hour average, while sellers capitulated around $2.23.

• The price recovered from a low of $2.19 to settle at $2.33, registering a 1% gain since the session opened.

• The overall crypto market capitalization fell 6% to $3.5 trillion as macroeconomic tensions and trade rhetoric between the United States and China spurred risk-averse flows.

• The SEC’s review of six pending XRP spot ETF filings continues through October 25, in conjunction with Ripple’s planned $1 billion treasury raise.

News background

The early session decline reflected weakness across the digital asset complex as investors reduced their exposure ahead of trading-related headlines and ETF deadlines. Despite a sharp morning drop from $2.33 to $2.19, XRP quickly stabilized as market depth recovered thanks to strong buying programs. Ripple’s billion-dollar fundraising initiative for its treasury division bolstered sentiment, while analysts framed the move as a “controlled turnover” rather than a structural weakness.

Price Action Summary

• XRP fell to $2.19 at 07:00 UTC on volume of 246.7 million, establishing key intraday support.

• The bulls regained control mid-session, driving a steady rise to resistance between $2.33 and $2.35.

• The last 60 minutes (04:22–05:21 UTC) saw a small rise to $2.32 followed by a bounce to $2.33 (+1.8%), with 1.69 million in peak tick volume.

• Consolidation between $2.32 and $2.34 formed the new short-term base, validating strong absorption near previous lows.

Technical analysis

• Support: $2.23 to $2.25 remains the key accumulation zone; exposure below $2.20 continues to attract long-term interest.

• Resistance: the intraday band between $2.35 and $2.38 limits the upside; Breakout confirmation above $2.40 is needed.

• Volume: peak of 246.7 million during liquidation; Last-minute surges (~1.7 million) indicate the return of liquidity.

• Trend – Gradual bullish bias after morning flush; RSI neutral, MACD stabilizing.

• Structure – Short-term consolidation between $2.19 and $2.35 suggests reaccumulation ahead of potential ETF holder catalysts.

What traders are watching

• ETF approval deadline (October 18 to 25) and possible market revaluation once the SEC’s determinations arrive.

• If $2.30 remains as base support during weekend operations.

• Ripple’s $1 billion treasury buildup continued and potential secondary market implications.

• Broader risk sentiment as tariff escalation reduces altcoin liquidity.

• Technical break above $2.40 as a sign of rotation towards the $2.70-$3.00 range.