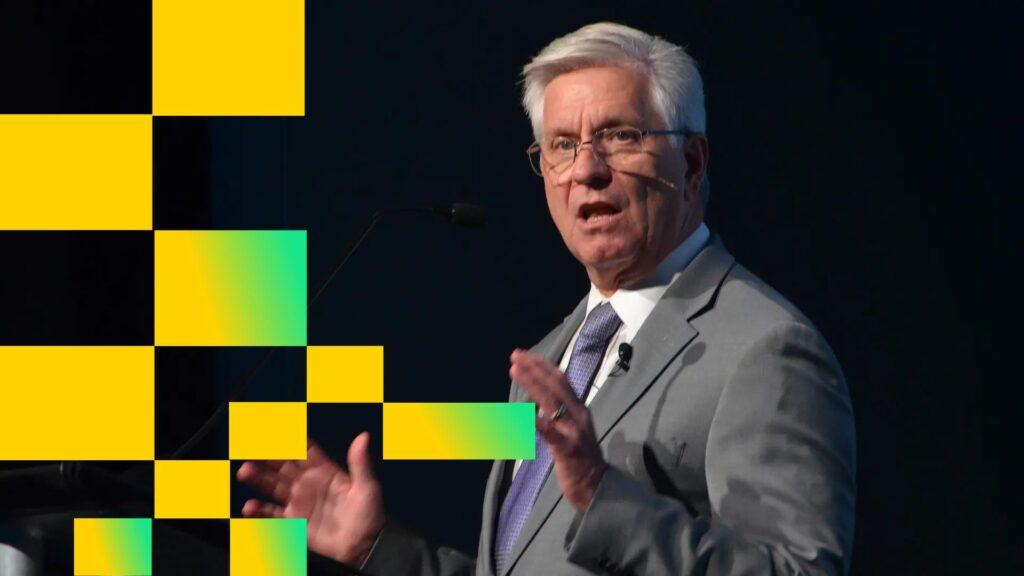

US Federal Reserve Governor Christopher Waller opened the central bank’s first payments innovation conference by pledging that the Fed will embrace innovations in the crypto sector and saying he has asked his staff to explore a lighter version of so-called “master accounts” that give financial firms access to US payment lanes.

“My view from now on from the Fed is to embrace disruption, not avoid it,” Waller said as she opened Tuesday’s event. “The Federal Reserve intends to be an active part of that revolution.”

Waller, who is one of the governors of the Fed’s seven-member board, is among President Donald Trump’s top potential candidates to replace Fed Chairman Jerome Powell when his term ends next year. He said he suggested Tuesday’s payments conference so that new crypto innovators would be in the same room as traditional payments infrastructure holders.

“I believe we can and should do more to support those who are actively transforming the payments system,” he said. “To that end, I have asked Federal Reserve staff to explore the idea of what I call a payment account.”

He described the idea as a “thin” version of full master accounts, allowing new payments participants a way to avoid the need for third-party relationships with institutions that have full accounts. He suggested that leaner payment accounts would “provide access to the Federal Reserve’s payment channels, while controlling various risks to the Federal Reserve and the payments system to control the size of the accounts and the associated impacts on the Federal Reserve’s balance sheet.”

They may, for example, not pay interest on balances, have daytime overdraft privileges, or grant access to loans through the Federal Reserve’s so-called “discount window,” and they may come with balance limits. Waller said the Federal Reserve would gather input on the idea and the industry will hear “more on this shortly.”

Waller is not the vice chair for supervision, so she is not in a position to immediately direct the Fed’s policy actions. The current vice chair is Michelle Bowman, and the general board is still led by Chairman Powell, who was appointed by Trump to that position but quickly came into conflict with the president during Trump’s first term. But Waller has proven to be a leading crypto ally at the Federal Reserve, and also just appeared at DC Fintech Week to praise decentralized finance (DeFi) innovations.

At that same event, Ripple CEO Brad Garlinghouse lashed out at Wall Street bankers’ resistance to cryptocurrency companies getting Fed master accounts, which his company is among those requesting. These accounts ensure smoother integration into the US financial system and direct access to central bank payments systems, rather than forcing crypto-native companies to rely on external relationships with banks.

“I wanted to send a message that this is a new era for Fed payments,” Waller said Tuesday. “The DeFi industry is not viewed with suspicion or contempt,” the new Fed conference called, “a recognition that distributed ledgers and cryptoassets are no longer on the sidelines, but are increasingly woven into the fabric of the financial and payments system.”

Read more: Cryptocurrencies are “nothing to fear,” says Fed Governor Chris Waller