The Meme coin is consolidating with almost psychological support, while institutional flows and high trading activity hint at building positions before a possible breakout.

News background

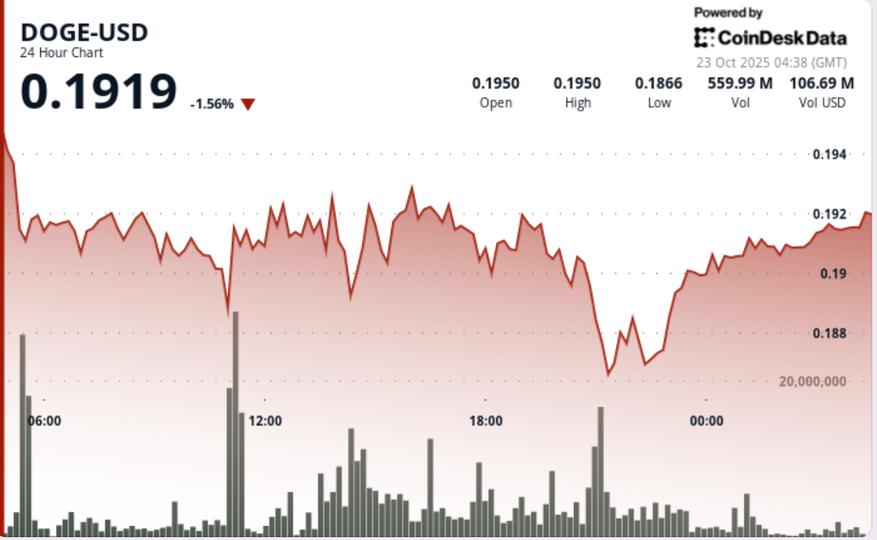

- Dogecoin fell 0.61% to $0.192 during the session on Tuesday, retreating from intraday highs of $0.195 as sellers limited gains at resistance.

- The move follows Monday’s brief push towards $0.20, with traders citing continued institutional profit-taking at upper resistance levels.

- Despite the subdued price action, trading activity increased 20.26% above the weekly average, with total turnover reaching 942.7 million tokens, roughly double the 24-hour average.

- High volume, coupled with limited price movement, indicates institutional accumulation rather than broad retail participation, suggesting positioning ahead of a potential breakout event.

Price Action Summary

- DOGE traded within a tight range of $0.0132 between $0.1860 and $0.1953 during the 24-hour period, remaining close to the psychological threshold of $0.19.

- The session’s volume peak of 942.7 million came as the token tested the $0.1925 resistance before retracing lower, confirming the near-term rejection.

- Support developed firmly around $0.1860, with repeated defenses throughout the mid-session window. The last hour of trading showed DOGE stabilizing near $0.1916 due to declining trading volume, reflecting balanced order flow after previous volatility spikes.

Technical analysis

- DOGE’s short-term structure shows constructive accumulation forming under resistance. Hourly data reveals higher lows of $0.1914, $0.1916 and $0.1920, confirming an ascending channel pattern supported by institutional volumes exceeding 10 million per candle during recovery sequences.

- Immediate resistance lies at $0.1925, while broader trend tops remain at $0.2060 and the monthly Fibonacci level near $0.2663.

- The sustained compression between the $0.1860 support and $0.1925 resistance highlights a tightening band of volatility that typically precedes larger directional moves.

What traders are watching

- Market participants are monitoring whether institutional flows maintain their momentum above current volume thresholds.

- A clear break above $0.1925 could expose short-term targets near $0.20-$0.21, while failure to hold support at $0.1860 risks renewing downward pressure towards the $0.18 zone.

- Traders identify the continued divergence between rising volume and flat price as a key accumulation signal, often a precursor to expanding volatility within 24 to 48 hours.