Dogecoin clears critical technical barriers on a 2.4% rally as institutional flows lift trading activity 68% above daily averages, indicating controlled accumulation within a broader Wyckoff phase.

News background

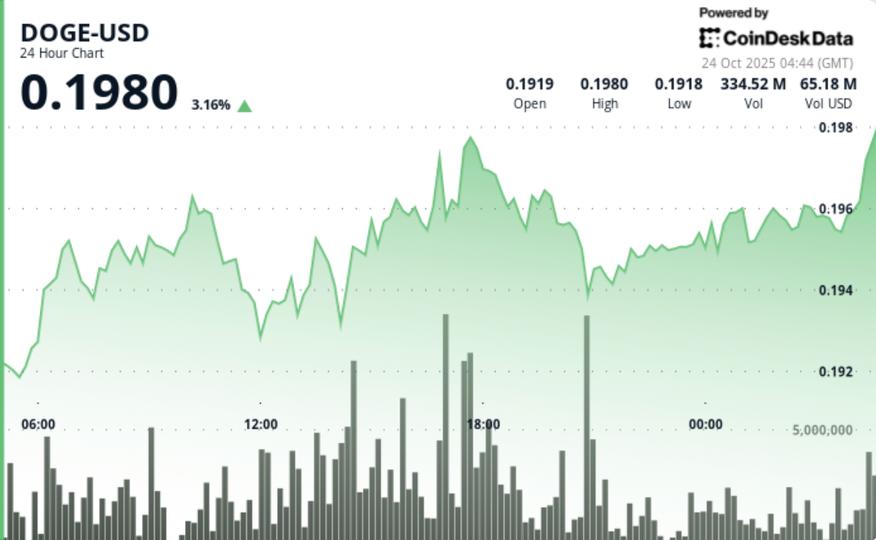

- DOGE rose 2.4% during the 24-hour session ending October 24 at 02:00, advancing from $0.1911 to $0.1957 and marking a clean break above the $0.1953 resistance zone.

- The move came with an exceptional volume of 483 million (68% above the 24-hour average of 287 million), confirming strong institutional participation in the advance.

- The memecoin traded within a tight intraday range of $0.0068 (3.5% volatility) while setting higher lows of $0.1931, $0.1936, and $0.1949, indicating consistent buying interest through each minor pullback.

- The analysts identified structural similarities to the Wyckoff accumulation phases seen in previous Dogecoin market cycles.

- Despite limited macro catalysts, traders noted that DOGE’s move coincided with a broader rally in high-beta altcoins, as market sentiment improved alongside Bitcoin’s recovery above $67,000.

Price Action Summary

- The breakout developed during the 11:00 session on October 23, when DOGE broke through the $0.1953 resistance in the highest volume of the day.

- The rally established new short-term support at $0.1940 as buyers absorbed supply during successive retests.

- In the final hours of trading, the price consolidated between $0.1954 and $0.1960 with decreasing volume, a sign that institutional accumulation had already occurred earlier in the session.

- Hourly data showed DOGE rose from $0.1955 to $0.1960 at 01:57 with volume near 9.97 million before retreating slightly to $0.1956, where support remained firm above the breakout levels.

- This controlled consolidation pattern indicates sustained demand within the new upper range, in line with ongoing institutional strengthening.

Technical analysis

- The DOGE price structure confirms a short-term uptrend with a sequence of higher lows and defined support at $0.1940.

- The break through $0.1953 validated the bullish setup, while the consolidation near session highs suggests strength rather than exhaustion.

- The volume profiles show institutional footprints concentrated during the breakout phase, not during profit taking, a hallmark of early accumulation.

- Analysts also highlight the resemblance to historical rounded bottom formations seen in previous market cycles (2017, 2021), which preceded multi-week vertical rallies.

- Momentum indicators show slight divergence but remain positive, reinforcing the case for continuation if DOGE holds the $0.194 support floor.

What traders are watching

- Market participants are monitoring whether DOGE can sustain above $0.195 and move into the margin phase typical of Wyckoff accumulation.

- A decisive break above $0.20 could trigger momentum-driven entries and attract algorithmic trend followers.

- On-chain data supports the bullish interpretation and shows a continued decline in DOGE reserves on the exchange, a sign of confidence from long-term holders.

- Immediate downside risk remains limited as long as support at $0.194 holds, but failure to defend that level could open a pullback towards $0.188.

- Institutional traders are expected to keep an eye on confirmation of continued volume strength on any retest of the $0.20 zone.