XRP is trading higher in a range-controlled action as institutional participation supports accumulation above the $2.38 zone even as derivatives data points to waning speculative interest.

News background

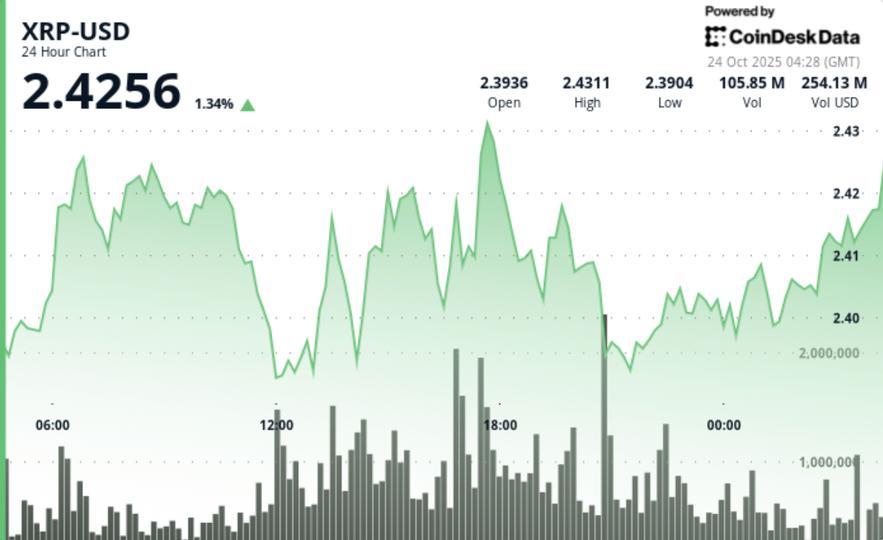

- XRP advanced modestly during the session on Tuesday, trading between $2.38 and $2.41, holding a narrow band of $0.05.

- The cryptocurrency continued to consolidate above key support despite broader uncertainty, with multiple intraday rejections near the $2.43 resistance highlighting the limited momentum.

- Trading volumes reached 79.86 million (about 94% above the 24-hour average) during a retest of support at midday, confirming institutional presence.

- That rise coincided with a rebound from the base of $2.38, suggesting accumulation behavior by larger holders as retail participation remained subdued.

Price Action Summary

- The most active window of the session came during midday trading, when sellers briefly drove XRP towards $2.38 before aggressive buying on the dips reversed the losses.

- The subsequent recovery to $2.41 reestablished the previous consolidation structure, leaving the token confined to a 2% intraday range.

- Hourly data shows a slight bullish bias, with XRP advancing from $2,397 to $2,405 around 01:47 on high volume.

- Multiple higher lows formed along this leg, supporting the short-term bullish channel even as broader crypto sentiment remained mixed.

Technical analysis

- The XRP chart continues to show ascending channel characteristics, with higher lows confirming controlled accumulation.

- The $2.38 to $2.39 zone remains key structural support, validated by volume spikes during testing periods. Resistance remains concentrated near $2.43, where repeated failures mark the upper limit of the consolidation.

- Derivatives data reveals a reduction in speculative activity: open interest decreased by 1.4%, while total trading volumes fell by 24% day on day.

- Funding rates turned slightly negative, standing at -0.0007%, suggesting that traders are leaning towards short positions. However, on-chain data shows a 3.36% drop in foreign exchange reserves since the beginning of October, a historically bullish signal tied to long-term whale accumulation.

What traders are watching

- XRP’s ability to hold above the $2.38 support area keeps the current accumulation thesis intact.

- A confirmed break above $2.43-2.48 would restore momentum and open space towards the $2.65 extension zone. On the contrary, if $2.38 is not defended, there is a risk of falling back to the support of $1.96.

- Traders are closely monitoring the volume behavior: another peak close to 80 million or more in a bullish attempt could confirm institutional accumulation and precede a phase of volatility expansion.