DOGE clears critical resistance levels with a 1.8% advance as trading activity surges 170% above average, confirming accumulation patterns near the $0.20 psychological zone.

News background

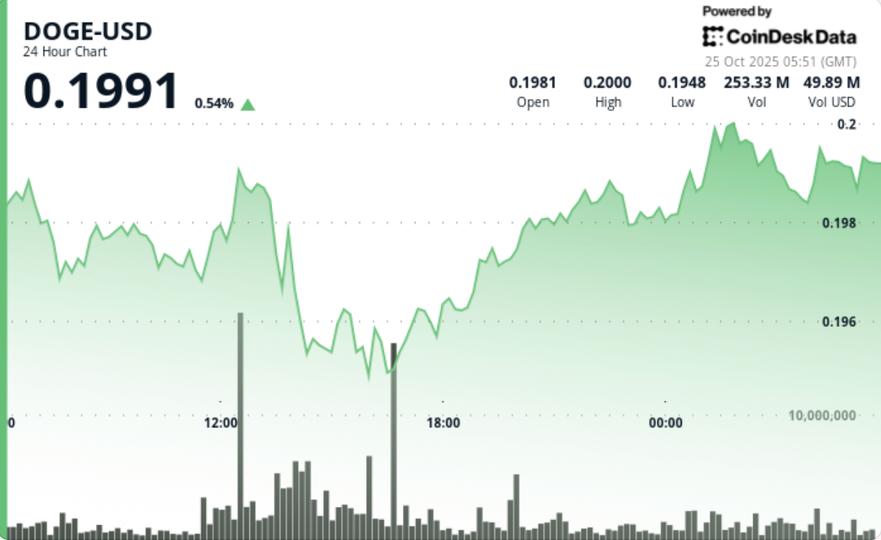

- Dogecoin gained 1.8% during the session on Tuesday, rising from $0.19 to $0.19 after decisively breaking the $0.1988 resistance level.

- The move came amid high trading volume of 674.52 million tokens (170% above the 24-hour average), indicating renewed institutional participation after a week of consolidation below the $0.195 barrier.

- The meme token established a series of higher lows from the $0.19 base, confirming a strengthening of the technical base.

- Analysts noted that the breakout came in line with broader risk-on sentiment in digital assets, as Bitcoin and Ethereum extended their gains earlier in the week, reinforcing DOGE’s correlation with large-cap market momentum.

- DOGE briefly tested the psychological threshold of $0.20 before entering a controlled consolidation phase near the session highs, with buyers defending gains despite late session profit-taking.

Price Action Summary

- The breakout phase began during the 11:00 window on October 23, when DOGE rose from $0.1963 to $0.1995 with explosive volume. Institutional inflows dominated during this period, with 674.52 million tokens traded (nearly triple the daily average), marking one of the busiest hours of the month.

- Following the initial breakout, DOGE firmly consolidated between $0.1990 and $0.2003, showing a strong balance between profit taking and continued buying interest.

- Short-term momentum remained constructive, with intraday lows consistently defended above $0.1974 and rising hourly support confirming accumulation rather than distribution behavior.

- The closing price structure suggested stabilization above previous resistance, with market depth data showing increased liquidity of bids around $0.1980-$0.1985.

Technical analysis

- DOGE’s current structure aligns with a continuation pattern forming within a controlled ascending channel. The clean break through the $0.1988 resistance validates the bullish bias, while the consolidation at the $0.2000 mark indicates preparation for the next impulsive move higher.

- Momentum indicators (MACD, RSI) remain supportive and show modest bullish divergence on hourly time frames.

- The volume dynamics reinforce the institutional narrative: the 170% increase confirms active positioning during breakout conditions, while subsequent normalization implies a measured distribution without structural deterioration.

- Analysts highlight the $0.1974-$0.1980 region as key support, and a confirmed close above $0.2003 will likely extend gains towards the $0.2020-$0.2050 range.

What traders are watching

- Market participants are tracking whether DOGE can hold above the $0.1985 to $0.1990 support zone, a level that has become the intraday pivot for continuation setups.

- A confirmed break above $0.2003 could attract momentum buyers and trigger an algorithmic follow-through towards higher resistance bands between $0.2030 and $0.2050.

- On-chain and order book data suggest continued accumulation, with whale wallet inflows up 2.1% in the last 48 hours.

- Traders note that further confirmation of this trend would validate the bullish accumulation thesis and strengthen conviction in a near-term retest of the $0.21 level.

- However, failure to hold current levels could reintroduce short-term volatility and cause a pullback towards the $0.1940 to $0.1950 support range.