DOGE outperforms broader crypto markets as volume surges nearly 10% above weekly averages, indicating early accumulation within the breakout structure.

News background

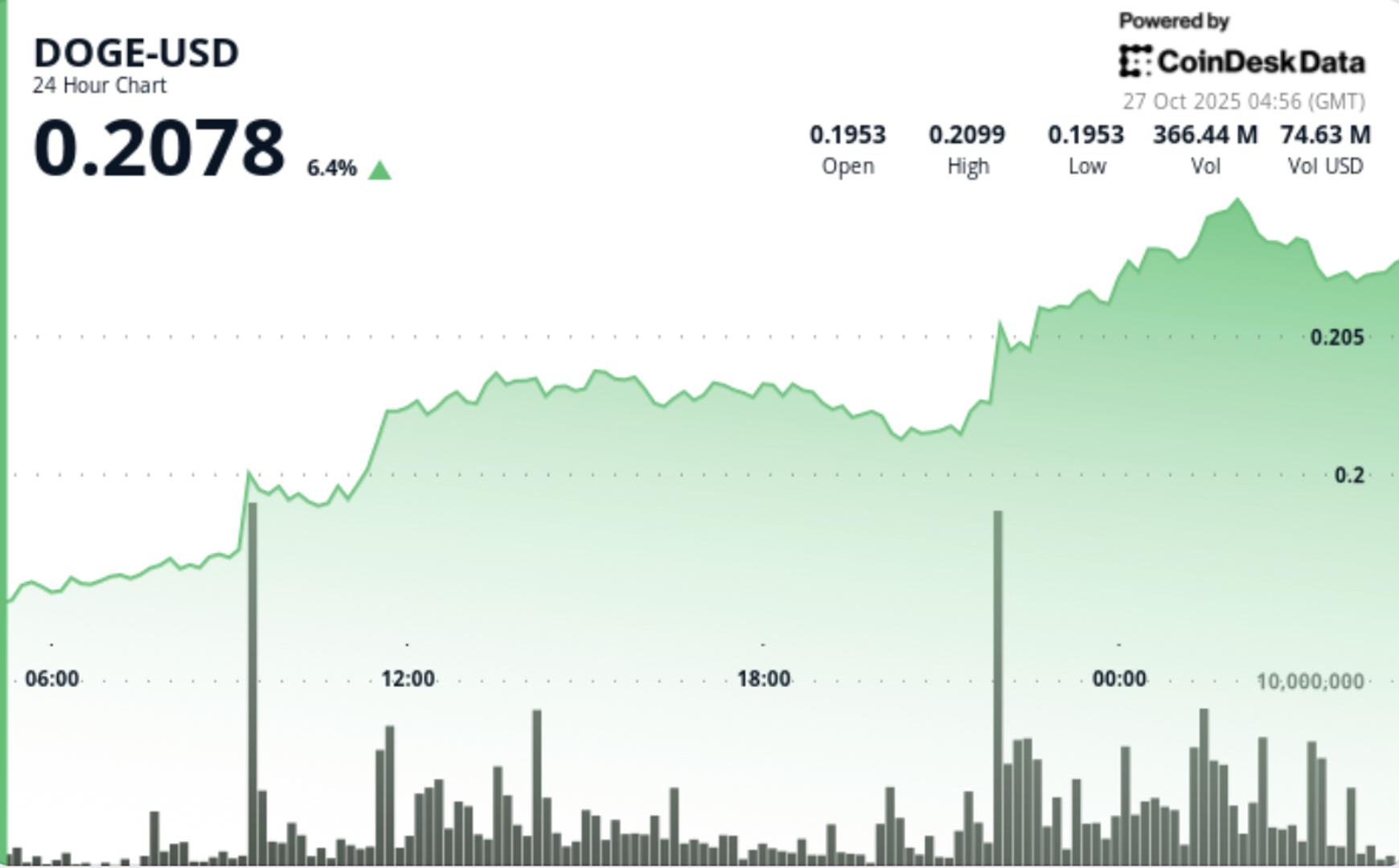

Dogecoin advanced 1.4% to $0.21 in Tuesday’s session, marking its first decisive move above the $0.2026 resistance threshold since late August. The meme coin’s price action demonstrated relative strength against the broader market, outperforming the CD5 index by more than 2%. Trading volumes increased 9.82% above the seven-day average, reflecting sustained institutional participation within the meme asset segment.

Market analysts said the breakout represents “early cycle momentum building” after nearly two months of compression in the $0.19 to $0.20 corridor. “DOGE’s resilience as Bitcoin and Ethereum consolidate suggests rotation flows are returning to higher beta assets,” said Rishi Patel, quantitative strategist at Bluepool Digital.

Price Action Summary

DOGE rose steadily from $0.1950 to $0.2072 over the 24-hour window, establishing a sequence of higher highs and higher lows in an intraday range of $0.0159. The key breakout occurred at 22:00 UTC, when volume spiked to 834.5 million chips-barely 180% above 24-hour moving average and the price surpassed the fundamental resistance level of $0.2026.

Momentum carried into the early trading hours of Wednesday, with DOGE briefly touching $0.2087 before encountering mild profit-taking. The pullback held comfortably above the $0.2070 support, confirming that the previous resistance has moved into a near-term demand zone.

Technical analysis

The technical configuration remains constructive. DOGE maintains an ascending trend line from the $0.1949 base, with successful retests of the $0.2060-$0.2070 zone underscoring buyers’ continued control. The RSI readings are around 58 on the 4-hour chart, coinciding with the early stages of an uptrend, while the MACD remains positive but is narrowing, reflecting short-term consolidation after the breakout burst.

Volume analysis shows a pattern of healthy distribution rather than capitulation, implying reaccumulation rather than depletion. The price structure remains aligned with a bullish continuation phase, although confirmation of momentum requires sustained closes above $0.2085.

What traders should know

- DOGE’s breakout above $0.2026 confirms a technical shift out of its multi-month consolidation range. Institutional flows continue to underpin price stability even as retail participation remains weak.

- A successful defense of the support between $0.2060 and $0.2070 could pave the way for a measured advance towards $0.2130, the 38.2% Fibonacci retracement level from the May-September decline.

- However, failure to hold the current support risks a short-term pullback towards $0.1990. Traders are watching for further volume increases above the 800 million mark as confirmation that smart money accumulation is still in play.