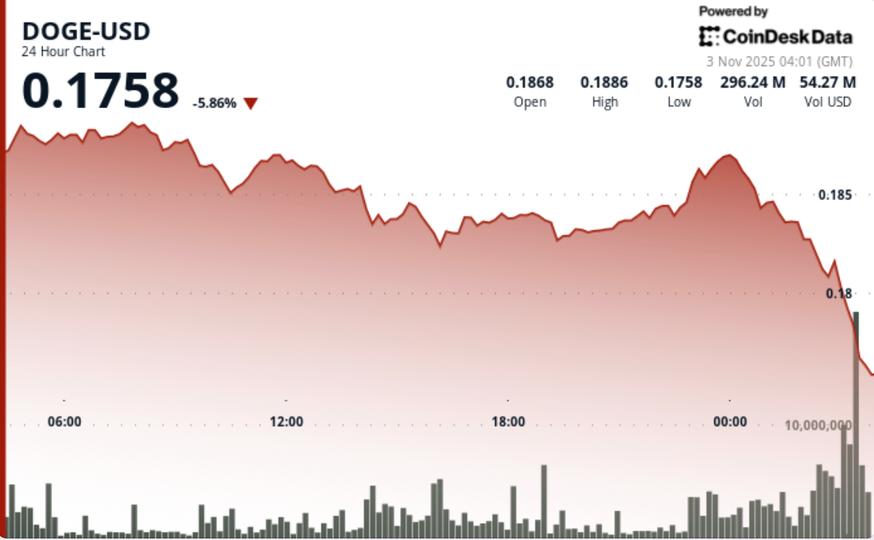

Dogecoin fell 2.3% to $0.1827 during the trading session on Tuesday, decisively breaking below the key support at $0.1830 as whale distribution accelerated and long-term holders began to exit their positions.

The decline came amid a deteriorating technical backdrop and increased sales activity in large portfolios.

News background

DOGE fell from $0.1870 to $0.1827 over the 24-hour period, creating a range of $0.0070 that marked its third consecutive session of lower highs.

Price Action Summary

The drop came after three failed recovery attempts above $0.1860, solidifying resistance at that level. The strong distribution persisted throughout the US trading window as algorithmic activity amplified selling pressure.

While short-term traders tried to defend $0.1830, data from long-term portfolios showed a strong change in behavior: a clear rotation from accumulation to liquidation.

On-chain metrics confirmed the move: 440 million DOGE was dumped by mid-level whales (holding between 10 and 100 million tokens) over a 72-hour period. Hodler’s net position change metric recorded 22 million DOGE outflows, a 36% reversal from previous accumulation trends and the largest drawdown in almost a month.

Technical analysis

Dogecoin’s technical structure has moved into a confirmed bearish trend following the break of the $0.1830 support. A “death cross” pattern formed between the 50- and 200-day EMAs in late October, while the 100-day EMA is on track for a similar crossover, reinforcing the bearish bias.

Cost-based analysis places high liquidity between $0.177 and $0.179, where approximately 3.78 billion tokens are concentrated. This area now represents the next critical defense zone for the bulls.

Meanwhile, volume analysis highlights sustained institutional activity: the turnover increase of 274.3 million and the subsequent burst of 15.5 million during the liquidation suggest that the distribution may be entering its final stage before possible base formation.

What traders should keep in mind

DOGE is trading in a vulnerable position after the collapse. The $0.1830 to $0.1850 band remains the immediate pivot zone, while failure to defend $0.177 could trigger a move towards $0.14, the next significant liquidity pocket.

Analysts warn that only a sustained recovery to $0.1860 accompanied by above-average volume would negate the current bearish setup. Until then, traders are treating short-term rallies as exit opportunities rather than trend reversals.

Whale activity remains the key alert point: any sharp decline in the large transaction count would signal the end of the distribution phase and the beginning of a potential buildup close to cost base support.