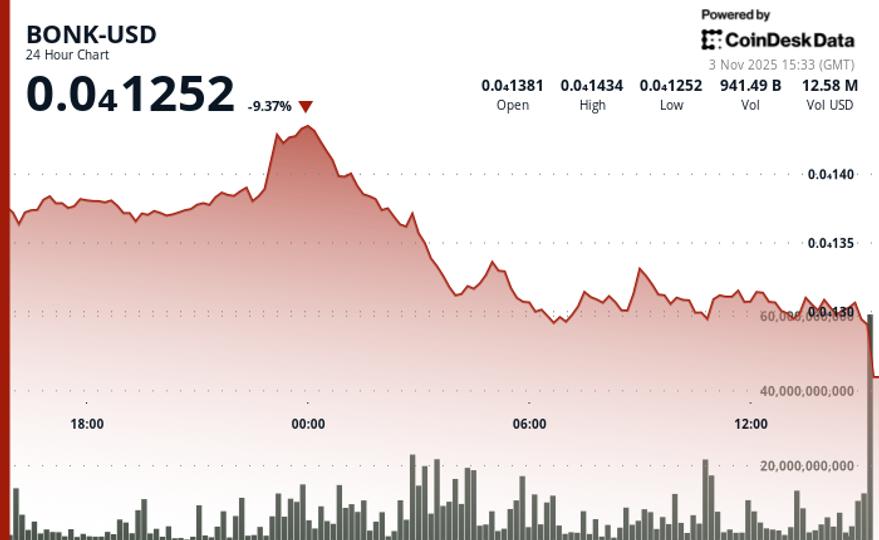

suffered a sharp drop at the start of the week, falling 11% to $0.00001232 as the Solana-based meme token fell through critical support.

The drop erased much of last week’s gains, confirming a short-term bearish shift, according to CoinDesk Research’s technical analysis data model.

Following a drop from $0.000014 to $0.000013, BONK plunged more than 6% to around $0.0000121 in the space of 30 minutes during the European afternoon.

The 24-hour trading range spanned between $0.00001252 and $0.00001434, reflecting intraday volatility of 8.5% as the memecoin reversed its early gains. Strong selling pressure emerged around 03:00 GMT, when volume increased to 964.3 billion tokens, a 46% jump above the daily average. This break below the $0.0000137 support solidified the bearish tone, with resistance reestablished near $0.0000144, the previous week’s rejection zone.

After consolidating between $0.0000129 and $0.0000131, BONK briefly rallied 5.3% to $0.00001309 during the late session recovery attempt. Short-term accumulation near $0.0000131 suggested traders were testing support, although momentum quickly faded. The muted follow-through underscores lingering caution as volumes fell below their previous peaks.

Technically, BONK remains under pressure as it is trapped below its resistance band of $0.0000137. The pattern of lower highs and consolidation of narrowing ranges points to an ongoing distribution phase. Traders are watching to see if the token can hold above $0.0000129 (the current support floor) to avoid a deeper decline. A decisive move above $0.0000137 would be needed to reestablish the bullish base and reverse the current trend.

Disclaimer: Portions of this article were generated with the help of artificial intelligence tools and were reviewed by our editorial team to ensure accuracy and compliance. our standards. For more information, see CoinDesk’s full AI policy.