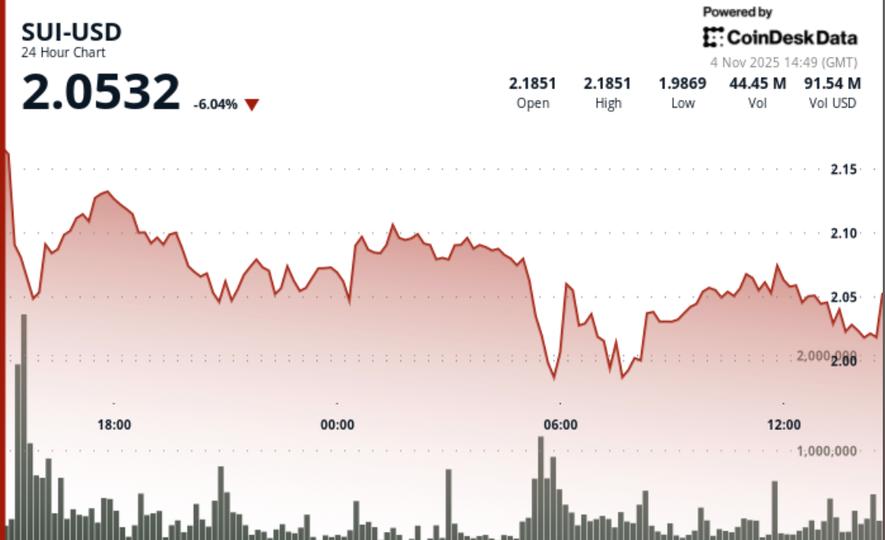

SUI, the native token of the Sui blockchain, fell on Tuesday after breaking through critical support levels and triggering a wave of technical selling. The token fell 9.2% to a low of $2.02 as trading volume increased and recovery attempts repeatedly failed.

The selloff came following Monday’s news of a $116 million exploit involving decentralized finance (DeFi) protocol Balancer, which has shaken sentiment across the industry.

As security concerns mounted, investors appeared to reduce their exposure to riskier layer 1 tokens, and SUI showed signs of institutional liquidation, according to CoinDesk Research’s technical analysis model. Nearly 42.6 million tokens changed hands during the crisis, 68% more than the daily average, according to on-chain data.

The $2.08 level, once a support zone, became resistance during the decline, with multiple failed rebounds reinforcing the downtrend. During US morning hours, SUI was hovering around $2.02 in low-volume trading, suggesting traders were positioning themselves ahead of the next major move.

Chart watchers noticed classic capitulation behavior: a collapse in a single hour, followed by lower highs and tight consolidation. If the token falls below $2.014, technical targets point towards $1.98 or even $1.95. To regain momentum, the bulls would need to reclaim $2.07 with conviction.

The CoinDesk 5 index of the largest cryptocurrencies fell 1.15% on the day with all components lower.

Disclaimer: Portions of this article were generated with the help of artificial intelligence tools and were reviewed by our editorial team to ensure accuracy and compliance. our standards. For more information, see CoinDesk’s full AI policy.