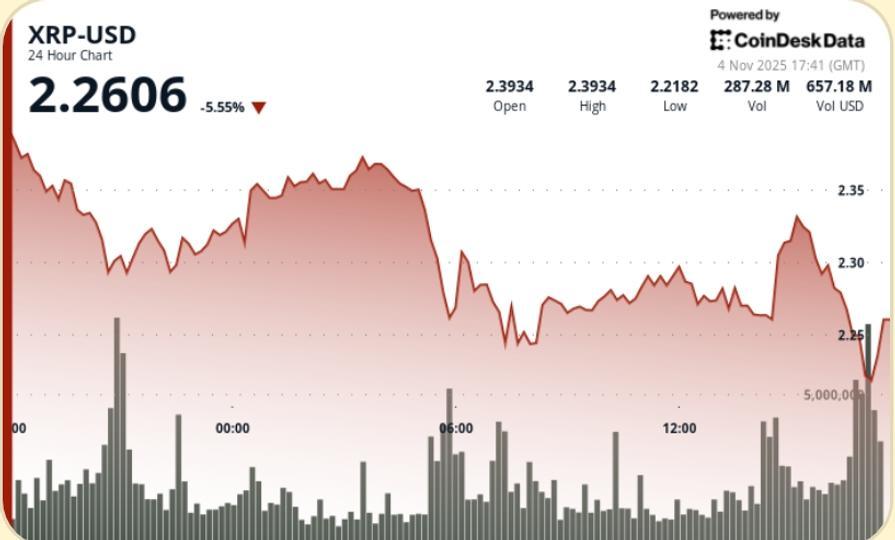

XRP extended its decline on Tuesday, falling 6% to $2.25, as whale selling and a clear trendline break accelerated downward momentum. The move, combined with a 15% drop in open interest, keeps pressure on bulls ahead of an imminent death cross setup and a key retest of $2.20 support.

What to know

• XRP fell from $2.39 to $2.25 (-6%), confirming a break below the multi-month ascending trend line.

• Whale wallets downloaded ~900,000 XRP in five days

• Open interest fell ~15% as leveraged long positions were unwound

• Volume skyrocketed to ~193.7 million during the breakdown period

• Bottom-High structure now set at $2.39 → $2.37 → $2.33

News background

The sell-off follows persistent whale distribution since late October, with large holders losing positions after repeated failures above the 200-day moving average. Macro risk also re-emerged across risk assets as open interest compressed across major companies, suggesting deleveraging (not panic in retail flow) drove Tuesday’s move. Analysts point to an imminent death cross setup as momentum indicators shift decisively to the downside, while some positioning desks pointed to bids near $2.20 as the next liquidity pool for possible stabilization.

Price Action Summary

• Inability to recover the $2.37–$2.39 supply zone

• Progressive distribution of lower treble signaling

• Trendline violation triggered accelerated selling of algorithms

• Volume increased ~87% vs. 24-hour average during the breakdown

• The session low was recorded at $2.24 before a modest bid recovery to $2.25.

Technical analysis

• Trend: Breakdown of ascending structure, bearish momentum

• MA: 50-day MA falling towards 200 days → cross risk of death

• Support: short-term base of $2.25; $2.20–$2.00 psychological layer; deeper pocket towards $1.85

• Resistance: the area between $2.37 and $2.39 remains the dominant supply wall

• Volume: Expansion confirms distribution; Exhaustion at the end of the session suggests a short-term pause

What traders are watching

• If the $2.20 level absorbs selling pressure or falls to $2.00

• Confirmation (or fading) of the death cross configuration

• Open interest stabilization after a 15% rise

• Whale wallet behavior after dumping ~900,000 tokens

• Recovery of the $2.37–$2.39 range as a bullish invalidation threshold