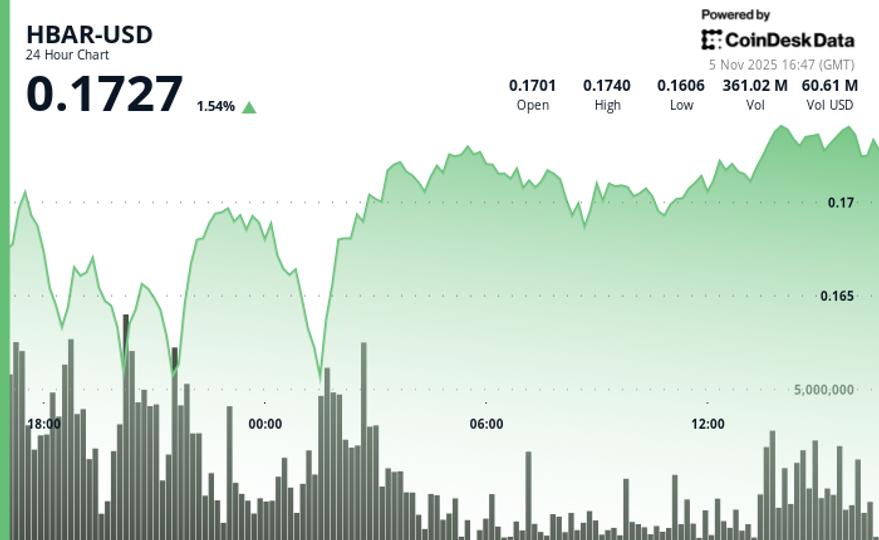

HBAR extended its advance on Tuesday, gaining 1.31% to $0.1725, as trading volume rose 38% above the 30-day average. The move followed broader crypto market momentum, supported by steady institutional flows. Despite the lack of fundamental catalysts, the elevated activity points to renewed trader interest in the Hedera network token.

The price action reflected a period of consolidation, with HBAR forming higher lows while repeatedly testing resistance levels. Its 0.41% outperformance against the broader crypto market remained within normal correlation ranges, suggesting a move driven by sentiment rather than project-specific developments.

Traders are closely watching the $0.1742 resistance level as HBAR trades in a tight range of $0.1701 to $0.1739. The 38% increase in volume highlights active position building, which often precedes a breakout attempt. However, the current pattern suggests tactical repositioning rather than full-scale accumulation, with the $0.17 zone emerging as a key psychological support area for potential bullish momentum.

HBAR Technical Analysis Summary

- Support and resistance

- Primary support at $0.1692.

- Key resistance at $0.1742.

- The volume-weighted support zone was established at $0.1601 during the previous decline.

- Volume analysis

- The increase in volume to 223.2 million at $0.1601 provides a solid technical basis.

- Late session consolidation with lighter volume suggests a position management phase.

- Chart Patterns

- The formation of an ascending triangle with multiple higher lows confirms a bullish background.

- The pattern targets $0.18 if the resistance is successfully broken.

- Objectives and risk

- Breaking above $0.1742 opens a path towards the $0.18 target.

- A failure below the $0.1692 support tests the critical volume group at $0.1601.

Disclaimer: Portions of this article were generated with the help of artificial intelligence tools and were reviewed by our editorial team to ensure accuracy and compliance. our standards. For more information, see CoinDesk’s full AI policy.