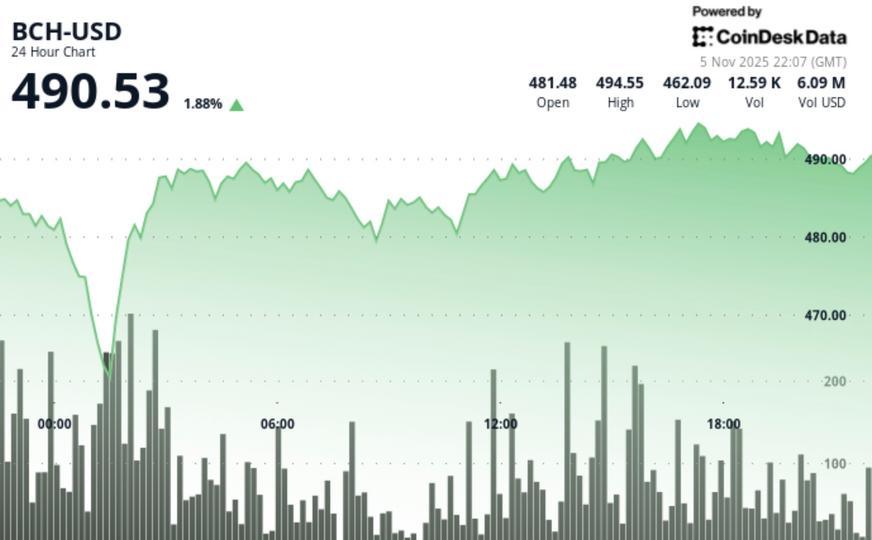

According to CoinDesk Research’s technical analysis data model, BCH rose 3.3% to $491.80 after breaking above $487 in above-average European session volume, recording a range of $33.36 and a brief pullback from a high of $495.30 that buyers quickly disappeared.

(Note that all timestamps are in UTC.)

Technical Analysis Highlights

- The price went from $476.10 to $491.80, an increase of 3.3%.

- The intraday range measured $33.36

- The highest lows were set at $462.67, $474.27, and $479.03.

- The break above $487.00 occurred during the European session thanks to sustained buying interest.

- The price reached a high of $495.30, then fell $3.20 to $490.14 before recovering to $492.99.

- Multiple attempts to break through $495 occurred between 4:00 p.m. and 5:00 p.m. on November 5.

- Volume peaked at 33,795 units on November 4 at 9:00 PM, compared to a 24-hour average of 13,478 units, an increase of 78%.

- The 0.65% retracement from the session highs was followed by a recovery above $491.00.

Patterns explained

The report describes an uptrend with a clear breakout: buyers repeatedly intervened at progressively higher lows, the price rose to $487 with stronger participation, then a small dip was quickly absorbed, keeping the momentum intact.

Support versus resistance map

- Support: Psychological level of $490.00 tested during a 60-minute correction; $487.00 breakout zone; $479.03 Highest Low

- Endurance: $495.00 area after several rejections; $495.30 session maximum

Objectives and risk framework

- Goals: Immediate bullish target at $495.30 with breakout potential above $500.00

- Invalidation/risk: Defend $487.00 to maintain bullish structure

- Context: Risk/reward favors continuation with a daily range of 7.0% indicating strong volatility

Disclaimer: Portions of this article were generated with the help of artificial intelligence tools and were reviewed by our editorial team to ensure accuracy and compliance. our standards. For more information, see CoinDesk’s full AI policy.