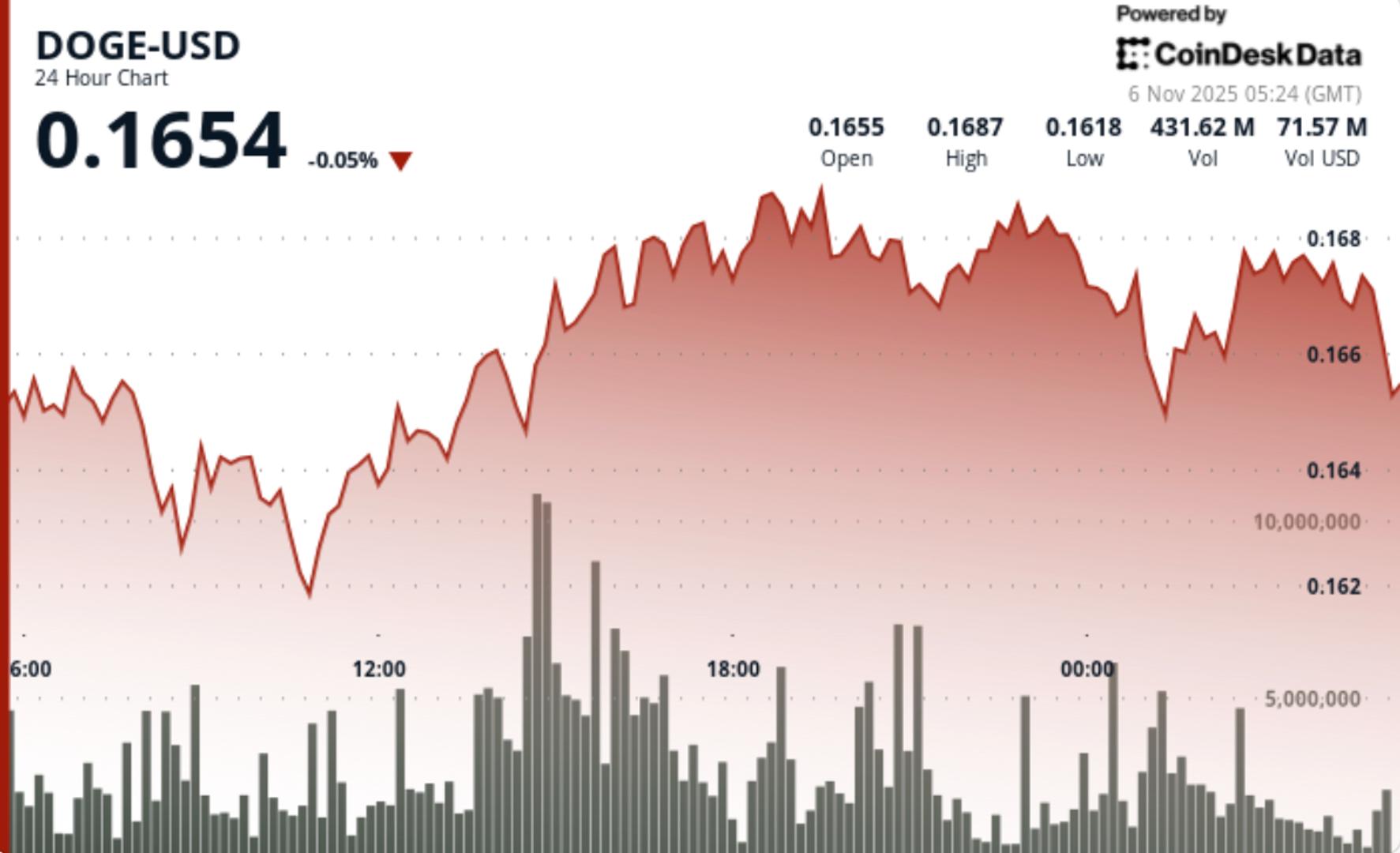

Dogecoin was down 0.5% at $0.1657 in Wednesday’s session as institutional flows rotated near resistance following a 104% volume surge above daily averages. The token defended its ascending channel structure despite distribution pressure at the upper boundary, maintaining the short-term bias from neutral to bullish above $0.16.

News background

- Institutional positioning continued to define DOGE’s intraday structure. Large cap holders accumulated near $0.1620 early in the week and then reduced exposure as bids decreased near $0.1670.

- Tuesday’s attempted breakout on volume of 774 million marked the turn of the session, confirming that smart money participation, not retail noise, fueled the move.

- Broader sentiment across the meme-coin complex remained muted, although derivatives open interest in DOGE futures rose modestly on Binance and Bybit, hinting at speculative hedging rather than outright risk-taking.

- Analysts said the pair’s resistance above $0.16 reflected disciplined profit rotation rather than trend exhaustion.

Price Action Summary

• DOGE advanced from $0.1646 to $0.1665 before a slight pullback to $0.1657

• Support held between $0.1617 and $0.1620 for four consecutive hourly tests

• Volume concentrated at highs of $0.1665 (8.9 million between 02:10 and 02:11), which shows the institutional distribution

• The channel structure remains constructive with higher lows, suggesting potential for further breakout attempts above $0.16.

Technical analysis

• Trend: Sideways to bullish within the ascending channel

• Support: $0.1620 primary; $0.1617 secondary buffer

• Resistance: Zone between $0.1665 and $0.1670 repeatedly rejected by high volume

• Volume: 774M turnover (+104% vs SMA) confirms institutional participation

• Structure: Intact channel, volatility 4.2%: compression phase that precedes the next directional movement.

What traders are watching

• Ability of bulls to defend $0.1620 on declining volume – key to integrity of structure

• Confirmation of breakout above USD 0.1670 for a continuation towards USD 0.17-USD 0.175

• Any intraday close below $0.1615 indicates a structural failure and downward expansion.

• Cross-asset flow from BTC or SOL rotations as the broader market gauges risk appetite