Dogecoin fell for the second straight session as large whale distribution and technical weakness overshadowed optimism around the expected launch of the Bitwise DOGE ETF within 20 days.

News background

Bitwise Asset Management confirmed that its Dogecoin spot ETF can launch within 20 days under the automatic Section 8(a) approval rule, pending SEC intervention. The move follows last week’s debut of the SOL, LTC and HBAR ETFs on Wall Street and signals the acceleration of institutional product development across the meme coin segment.

Grayscale also modified its own DOGE spot ETF filing, initiating a similar countdown period. The parallel efforts underscore how regulators’ passive stance under Section 8(a) could accelerate listings even without explicit SEC support.

Despite broader optimism, DOGE price action sharply decoupled from the ETF narrative as large holders liquidated positions to strengthen them. On-chain data recorded over 1 billion DOGE (~$440 million) moved through whale wallets in the last 72 hours, coinciding with the largest distribution week since early October.

Price Action Summary

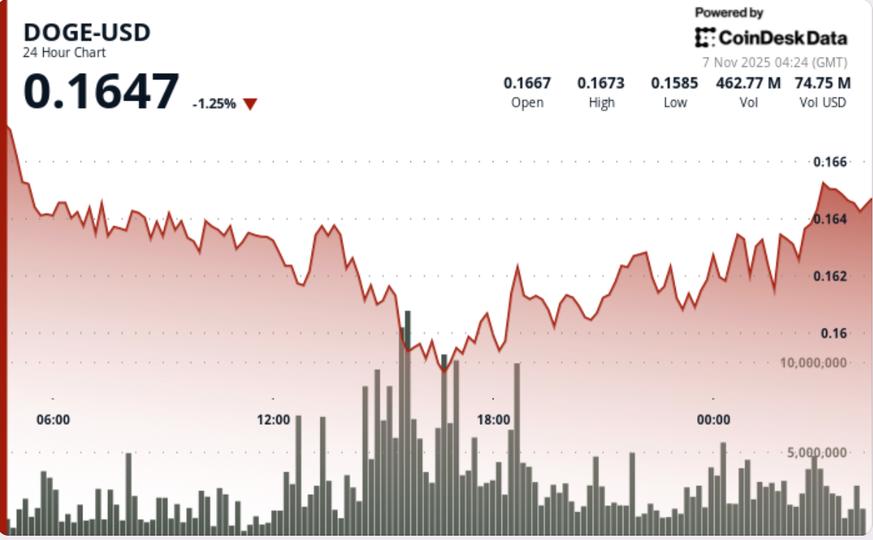

DOGE fell 2.4% to $0.1634 during the 24-hour session, breaking below the $0.167 support amid accelerated sell-offs. The token traded through a 6.4% intraday range, setting sequential lower highs during the first 16 hours of trading.

The steepest drop occurred at 15:00 GMT, when volume increased to 793.4 million tokens (about 150% above average), taking DOGE to its session low of $0.1590. Multiple bounce attempts failed at the $0.1639 resistance, confirming the persistent supply overload.

Late trading brought stabilization as DOGE rebounded from $0.1615 to close near $0.1631, with late-breaking activity averaging 6.2 million tokens per minute, slightly above the norm and signaling a measured re-entry by institutional participants.

Technical analysis

The session produced a classic breakout and retest pattern, confirming short-term bearish control and hinting at a possible base formation. Falling highs from the open validated resistance near $0.1674, while late-session higher lows between $0.1615 and $0.1625 set the initial framework for a possible reversal.

Momentum indicators remain mixed. The RSI recovered from almost oversold territory (38-42 band) and the flattening of the MACD suggests a slowdown in the bearish momentum. However, with aggregate futures open interest falling 12% and funding rates turning negative on Binance, speculative appetite remains subdued.

The volume profile supports a transition phase: a strong distribution at the beginning followed by a measured accumulation at the end of the session. This structure often precedes short-term consolidation before volatility compresses ahead of a decisive breakout.

What traders should know

Traders are now focusing on whether DOGE can defend the support between $0.1575 and $0.1615 as ETF-driven sentiment rises. The ETF countdown could act as a catalyst for volatility, but the technicals remain fragile until the price closes above $0.1674.

If the bulls reclaim that level, short-term bullish targets will line up between $0.172 and $0.180, coinciding with the pre-breakdown bid. Conversely, failure to hold $0.1575 risks exposing the $0.15 psychological zone, where on-chain cost data clusters.

The interplay between ETF holders and whale flows will likely dictate the near-term direction: sustained outflows from large holders could limit any ETF-driven optimism until mid-November.