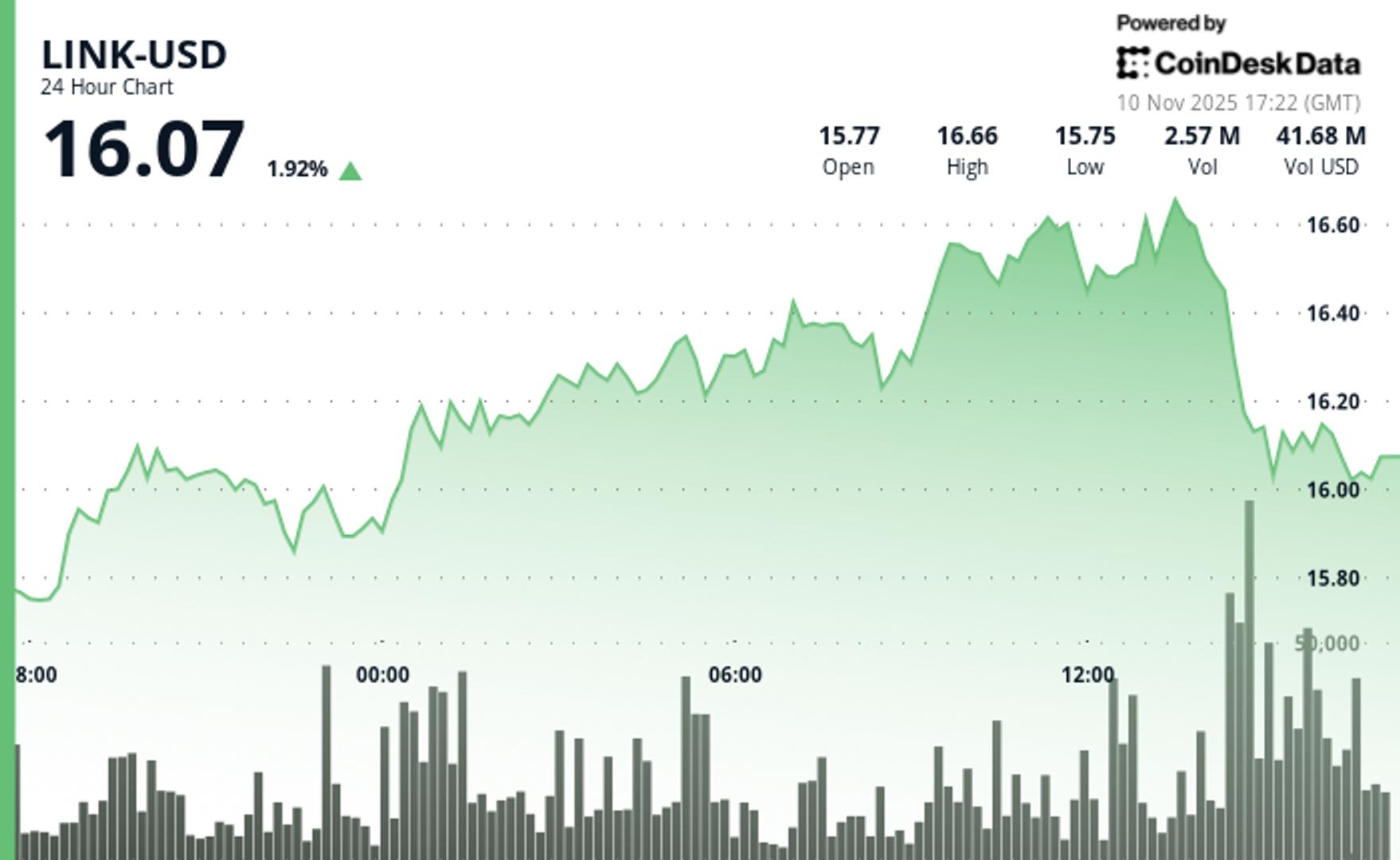

Chainlink native token LINK rebounded on Monday, advancing 5.2% over the 24-hour period to a session high of $16.66 before profit-taking occurred.

The price jump followed a steady upward trend with higher lows and strong trader participation, but failure to hold above $16.50 indicated short-term exhaustion, according to CoinDesk Research’s technical analysis model.

The most significant move came at midnight UTC, when 1.82 million tokens changed hands (almost 70% above the daily average), confirming a break above the critical $16.00 level and validating the momentum of the rally.

However, the uptrend stalled as traders began taking profits near the session highs. Volume surpassed 60,000 tokens in a short sale after 14:00 UTC, bringing LINK back around $16, limiting bullish continuation attempts for now, according to the model.

The action occurred just before Chainlink Rewards Season 1, which will launch on November 11. The program allows eligible LINK participants to earn token rewards from nine partner projects by allocating non-transferable points called Cubes.

Key Technical Levels Consolidation Signals for LINK

- Support/Resistance: Major support is established at $16.47 following the breakout, and $16.50 now serves as immediate resistance following the failed breakout attempt.

- Volume analysis: The midnight surge to 1.82 million shares (69% above average) confirms the validity of the breakout, although subsequent selling pressure exceeds the 60,000 volume during the reversal.

- Chart Patterns: 24-hour uptrend with higher lows intact despite failure of 60-minute consolidation; The range of $16.51 to $16.66 defines the short-term limits

- Objectives and risk/reward: Bulls are targeting a return above $16.50 to continue towards $16.66, while a fall below $16.47 could test the support at $16.30 with $16.00 as the final downside target.

Disclaimer: Portions of this article were generated with the help of artificial intelligence tools and were reviewed by our editorial team to ensure accuracy and compliance with our standards. For more information, see CoinDesk’s full AI Policy.