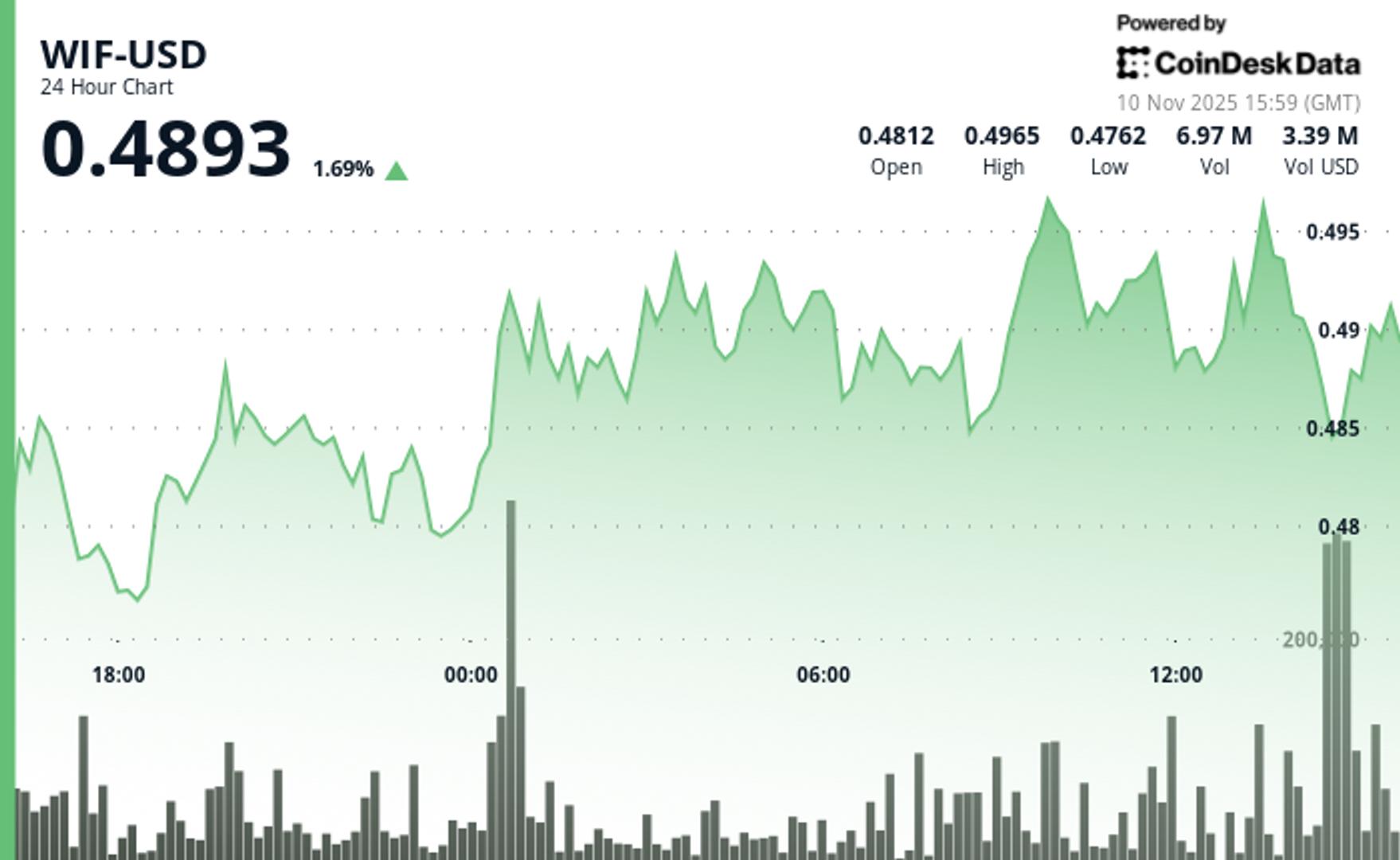

According to CoinDesk Research’s technical analysis data model, dogwifhat (WIF) staged a measured accumulation phase before explosive gains took the memecoin to session highs near $0.497 during trading on Tuesday. WIF spent most of the 24-hour period consolidating between $0.4754 and $0.4897 before breaking out dramatically overnight with institutional-level volume.

The breakout materialized at 12:00 AM on November 10, when trading volume skyrocketed to 12.51 million shares, a 98% increase above the session average of 5.62 million. WIF decisively broke above the resistance at $0.4840 and held support at $0.4775, confirming three consecutive higher lows from the bottom of the session. The surge in volume validated genuine buying interest as the token advanced through technical resistance levels.

Late session action turned aggressive as WIF rose from $0.491 to $0.497 at 13:37 before profit-taking emerged. Volume skyrocketed to 437,000 shares at 2:02 p.m., as selling pressure forced a pullback to $0.491 by the close of the session. The sharp reversal from $0.497 suggests that institutional players took profits in the face of technical resistance.

Consolidation vs. Breakout: What Traders Should Keep in Mind

With no fundamental catalysts, technical levels dominated the price action as the WIF navigated between defined zones of support and resistance. The overnight breakout with genuine volume confirms institutional participation, while the rejection at $0.497 establishes clear resistance for further testing.

The $0.490-$0.485 support zone becomes critical for bulls defending the breakout structure. Gap conditions until 14:13 indicate incomplete price discovery at the highs, positioning WIF for a continuation above $0.497 or a deeper pullback depending on volume follow-through.

Key Technical Levels Signal Retest Potential for WIF

Support/Resistance:

– Primary resistance set at $0.497 (session high with take profit)

– Secondary resistance at $0.4897 (ceiling of consolidation range)

– Critical support zone: $0.490-$0.485 (breakout retest level)

– Base support confirmed at $0.4775 (validated during increased volume)

Volume analysis:

– Breakout confirmation: 12.51 million shares (98% above 24-hour average)

– Resistance Test Volume: 437,000 shares at a high of $0.497

– Volume contraction to 1.37 million indicates pause in momentum at highs

Chart Patterns:

– Adjusted consolidation: range of $0.4754-$0.4897 (5.0% spread)

– Three consecutive higher lows establishing a bullish base structure

– Gap conditions near session highs indicate incomplete price discovery

Objectives and risk/reward:

– Immediate focus: Retest $0.490-$0.485 support for continuation setup

– Breakout Target: A clear break above $0.497 opens an extended rally

– Stop Loss: Below $0.4775 invalidates the bullish breakout structure

CoinDesk 5 Index (CD5) Posts Solid Gains Despite Late Session Consolidation

CD5 rose from $1,783.62 to $1,848.07 for a gain of $64.45 (3.61%) with momentum reaching $1,850.33 before sellers appeared at resistance.

Disclaimer: Portions of this article were generated with the help of artificial intelligence tools and were reviewed by our editorial team to ensure accuracy and compliance with our standards. For more information, see CoinDesk’s full AI Policy.