Institutional flows accelerated on Tuesday as XRP broke out of broader crypto weakness, posting steady gains amid greater regulatory clarity and controlled accumulation into key support zones.

News background

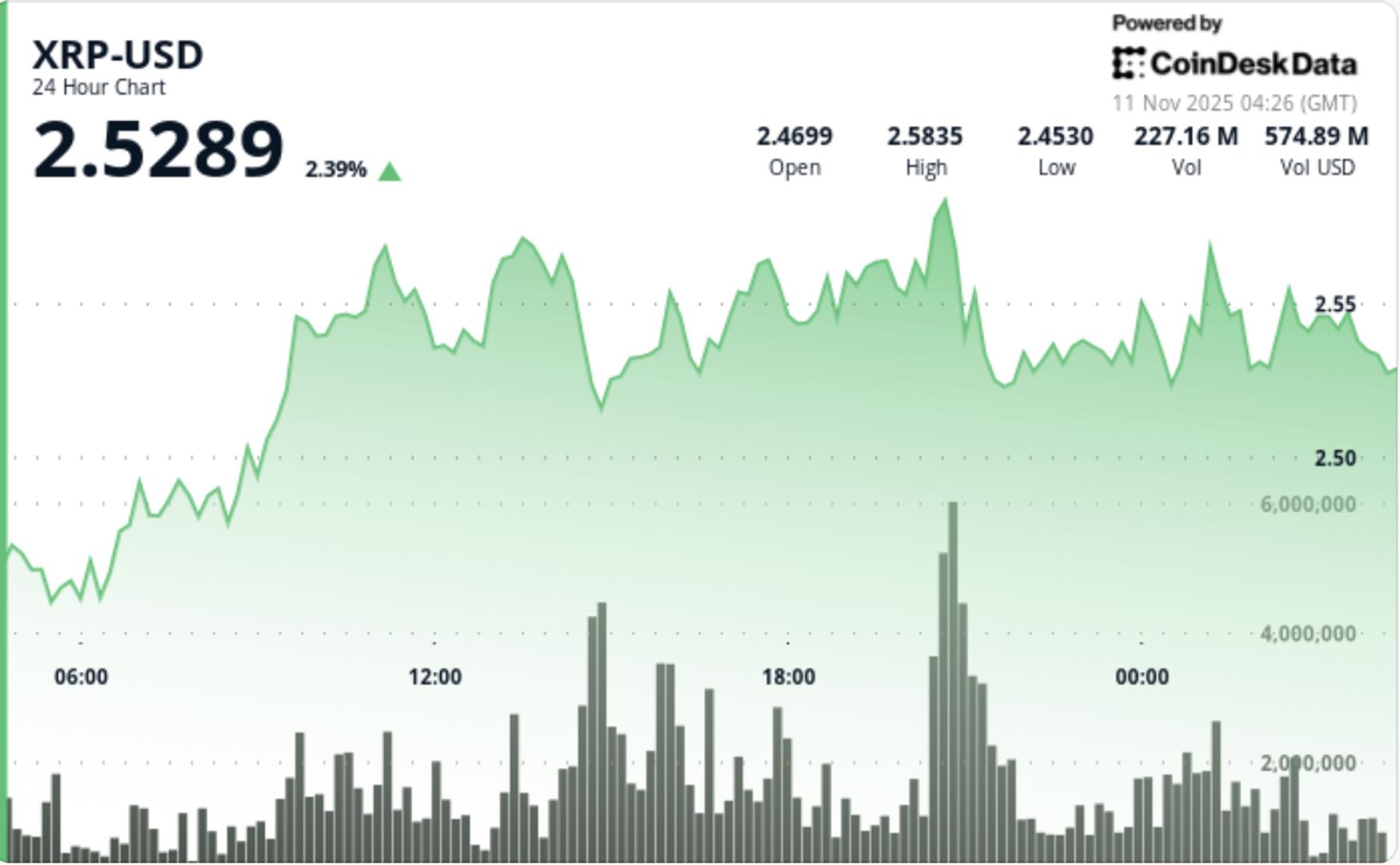

- XRP rose 1.55% to $2.53 in Tuesday’s session, outperforming the broader crypto market by 2.33 percentage points. The advance came as investors continued to build positions thanks to renewed optimism around regulatory progress and ETF developments, while overall digital assets traded mixed.

- Canary Capital, Bitwise, Franklin Templeton and 21Shares filed amended S-1 registration statements for XRP spot exchange-traded funds, introducing standardized listing language designed to expedite SEC review under existing 8(a) procedures.

- All five XRP spot ETFs have been listed on DTCC ahead of a possible US launch this month.

- Trading volume increased by 20.71% above the seven-day average, confirming institutional participation. Market data showed that 140.2 million tokens changed hands during the session peak (86% above the 24-hour moving average), underscoring sustained professional flows at higher price levels.

- XRP’s move contrasts with the sector’s underperformance, highlighting the token’s decoupling as regulated exposure expands globally and on-chain data points to controlled accumulation among large holders.

Price Action Summary

- XRP traded within an intraday range of $0.13, advancing from $2.47 to $2.54 while forming higher lows at $2.45, $2.50, and $2.52.

- The attempted breakout of $2.57 met resistance as profit-taking emerged, although buyers held firm above the $2.52-2.53 zone to confirm short-term support.

- The volume distribution showed disciplined accumulation rather than speculative spikes, with buying concentrated at mid-levels, which is consistent with institutional scaling behavior.

- Late trading showed sustained supply activity above $2.52 as volatility normalized from early session highs.

Technical analysis

- XRP maintains its ascending structure on the 4-hour chart, with the RSI at 58 supporting further bullish potential. The MACD remains positive with a widening histogram, indicating strengthening near-term momentum.

- The token’s failure to break above the $2.57 resistance highlights the risk of near-term consolidation, although the broader uptrend remains intact as long as the price remains above $2.50.

- Volume patterns reinforce constructive positioning: the 21% rise above average coincided with stable volatility bands, suggesting controlled accumulation.

- Order book depth on major exchanges shows consistent buy-side stratification between $2.48 and $2.52, an early sign of institutional defense ahead of macro catalysts.

What traders should know

- XRP’s ability to hold above $2.50-$2.52 remains key to maintaining bullish momentum.

- A daily close above $2.57 would confirm the continuation of the breakout with the target between $2.65 and $2.70, while failure to defend the support could trigger a corrective move towards $2.45 and $2.47.

- Analysts note that the ETF’s progress and Ripple’s growing institutional partnerships continue to underpin long-term sentiment, although near-term overextension risks warrant caution ahead of major data releases later in the week.