bitcoin and the rest of the cryptocurrency market continued the trend of not only losing ground, but noticeably sliding during US market hours.

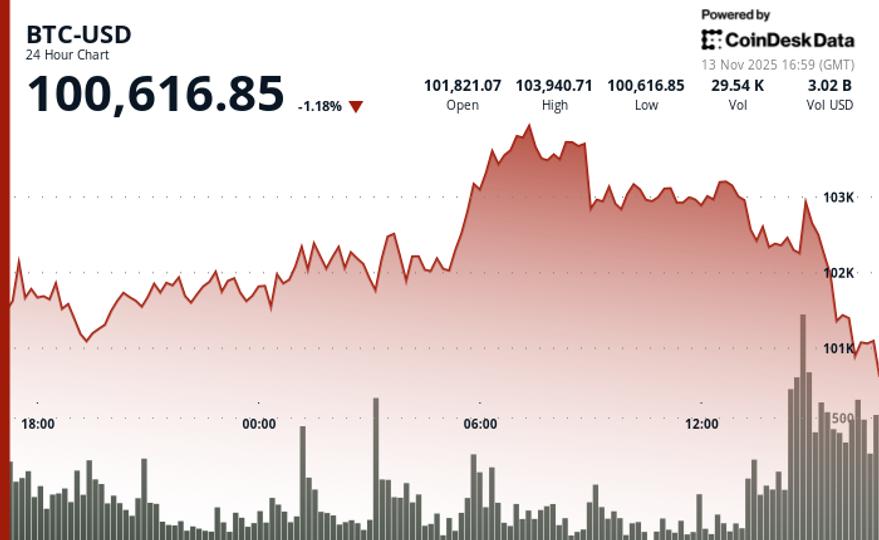

Following a recent pattern, BTC had bounced as high as $104,000 overnight but reversed course in the early US hours, barely holding above $100,000 just after midday on the East Coast and is now down over 1% in the past 24 hours.

The pullback came amid a broad and sharp decline in risk assets as investors grapple with the idea that the Federal Reserve (for now) appears to have no intention of cutting rates in December. The Nasdaq is down 2% and the S&P 500 is down 1.3%.

Crypto-linked stocks were hit hard once again, especially miners with heavy AI infrastructure and data center exposure. Bitdeer (BTDR) plunged 19% and Bitfarms (BITF) fell 13%, while Cipher Mining (CIFR) and IREN lost more than 10%. The rest of the cryptocurrency sector also saw heavy losses: Galaxy (GLXY), Bullish (BLSH), Gemini (GEMI), and Robinhood (HOOD) fell between 7% and 8%.

BTC peak in 2025 could be in

The pullback underscores a trend that has defined crypto markets in recent weeks: persistent weakness during US time, coinciding with cooling expectations of a December rate cut by the Federal Reserve.

“Cryptocurrencies are closely linked to the macroeconomy now more than ever in the past,” said Paul Howard, senior director at trading firm Wincent.

With markets now pricing in roughly 50/50 odds for a 25 basis point rate cut next month, Howard expects BTC to remain quiet near current levels for the rest of the year.

“My feeling is that with only six weeks left, we have seen all-time highs for 2025,” he said. “From here, we are likely to see a steady rise over the course of next year, recognizing the volatility.”