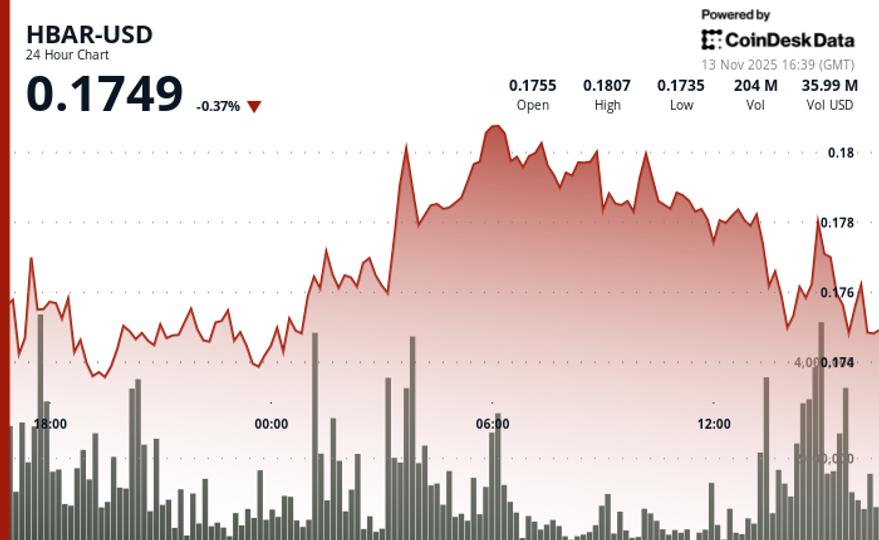

HBAR retreated 3.5% from $0.1817 to $0.1754 during Wednesday’s session, breaking key support despite institutional flows reaching $68 million through ETF channels.

The token faced rejection with resistance at $0.1805 following a morning spike that hit a high of $0.1802 on significant volume, 79% above daily averages.

Volume dried up following the morning’s initial surge, suggesting institutional buyers took a step back, while retail participants fueled weakness late in the session. The 4.5% intraday range reflects higher volatility despite weak cryptocurrency market conditions.

HBAR’s price weakness is in stark contrast to institutional positioning through the Canary HBAR ETF, which amassed $68 million in six trading sessions. Thirteen ETF filings in total now include HBAR exposure, indicating a growing institutional appetite for exposure to the Hedera ecosystem.

Key Technical Levels Indicate Extended Weakness for HBAR

- Support/Resistance: Critical support at $0.1740 is now tested with firmly established resistance at $0.1805 following multiple rejections.

- Volume analysis: The morning peak of 125.8 million shares marked 79% above averages but generated insufficient follow-on buying.

- Chart Patterns: The distribution structure confirms the bearish momentum with consecutive lower highs indicating continued bearish pressure.

- Objectives and risk/reward: Immediate targets point towards the $0.1720-$0.1700 support zone with the upside limited to the $0.1805 resistance barrier.

Disclaimer: Portions of this article were generated with the help of artificial intelligence tools and were reviewed by our editorial team to ensure accuracy and compliance with our standards. For more information, see CoinDesk’s full AI Policy.