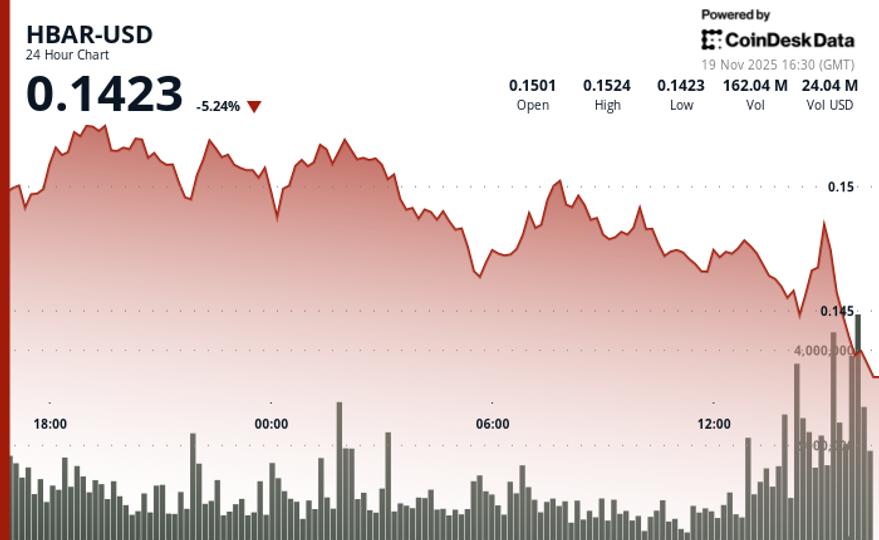

Hedera’s HBAR fell below key technical support levels on Tuesday, extending a 24-hour decline from around $0.1459 to $0.1451. The token hit multiple lower highs within a tight range of $0.0074, producing a 4.9% intraday swing that highlighted growing structural weakness in the market.

Trading activity increased to 145.7 million tokens on November 18, about 73% above its moving average, reinforcing strong resistance at $0.1525 and pointing to a possible institutional sell-off. Failure to sustain bounces, including a high volume rejection at 14:07, underlined the persistent downward momentum as HBAR decisively broke below the $0.1458 support level.

With no major fundamental catalysts in play, technical factors continued to drive sentiment. The combination of increased volume on breakouts, repeated failed bounce attempts, and the alignment between broader 24-hour weakness and near-term selling pressure suggests traders may face additional downside risks before a significant recovery can form.

Key Technical Levels Indicate Extended Weakness for HBAR

- Support/Resistance: Primary support is at $0.1451 and resistance at $0.1525; The breakout of $0.1458 opens the way to the session lows.

- Volume analysis: Institutional sales peaked at 145.7 million tokens during the stress test; Decreased tracking suggests completion of the distribution cycle.

- Chart Patterns: The formation of lower highs confirms the acceleration of the trend; The failed bounces at 14:07 with a volume increase of 5.2 million validate the breakdown scenario.

- Objectives and risk/reward: The next downside target is the support at $0.1451; The recovery faces resistance at the broken $0.1458 level which now acts as general supply.

Disclaimer: Portions of this article were generated with the help of artificial intelligence tools and were reviewed by our editorial team to ensure accuracy and compliance with our standards. For more information, see CoinDesk’s full AI Policy.