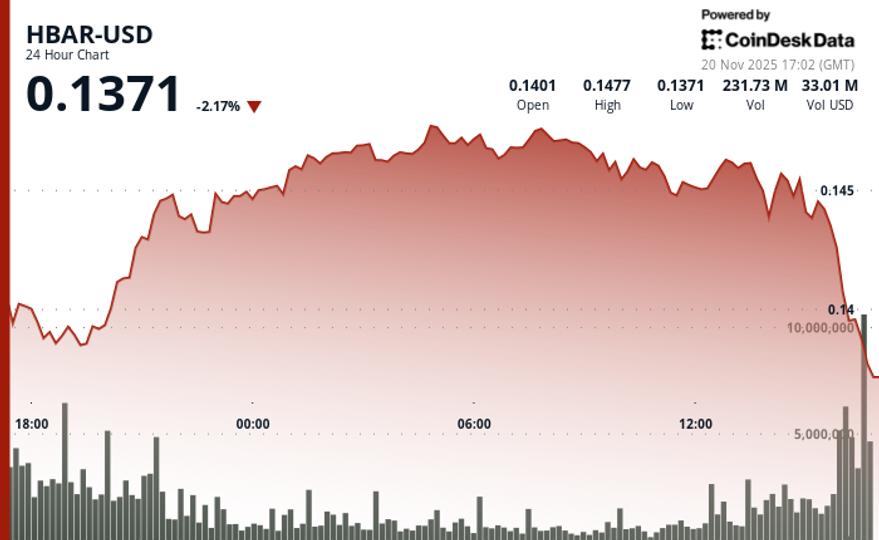

HBAR fell to $0.1373, decisively breaking below its established support of $0.145 after failing to maintain its consolidation range. The token sell-off at the end of the session confirmed a shift from a neutral structure to a clear bearish setup as the price action deteriorated towards the close.

Liquidity fractured sharply in the last hour, including a brief trading halt between 2:12 p.m. and 2:14 p.m. that saw zero volume. That pause in trading activity raises red flags about potential structural issues or a short-term liquidity crisis, both of which can amplify downward pressure during periods of stress.

Early in the session, a 138% increase in volume highlighted strong resistance at $0.1486. Although HBAR initially experienced a V-shaped bounce from its intraday low of $0.1382, the buying momentum quickly faded, leaving the asset vulnerable to the subsequent breakout.

Key Technical Levels Signal Breakdown Risk for HBAR

Support/resistance analysis:

- Primary support at $0.1382 becomes critical after failure of consolidation range.

- Previous support at $0.1445 is likely to act as resistance on recovery attempts.

- Key resistance remains at $0.1486, where increased volume marked rejection.

Volume analysis:

- 146.94 million tokens increased by 138% above the average 61.8 million tokens in the distribution phase.

- The volume contraction to 9.76 million tokens precedes a critical crisis.

- Breaking trading volume at zero indicates serious liquidity stress.

Chart Patterns:

- Consolidation range between $0.1446-$0.1477 invalidated by breakdown.

- The V-shaped recovery pattern from $0.1382 fails to maintain momentum.

- The total trading range of $0.0096 (6.5%) suggests higher potential for volatility.

Risk/reward assessment:

- A break below $0.1440 points to support at the $0.1382 level.

- The recovery faces immediate resistance at the previous support of $0.1445.

- The suspension of trading raises concerns about market depth and liquidity infrastructure.

Disclaimer: Portions of this article were generated with the help of artificial intelligence tools and were reviewed by our editorial team to ensure accuracy and compliance with our standards. For more information, see CoinDesk’s full AI Policy.