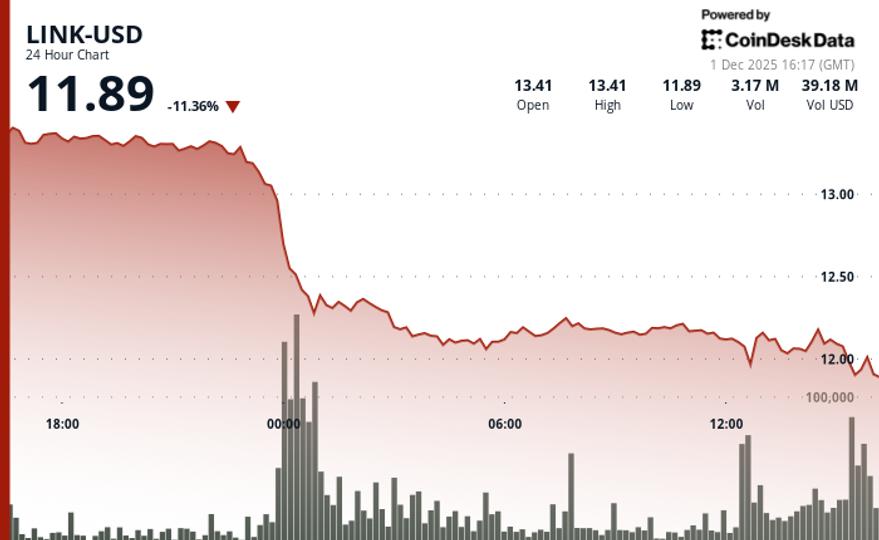

The native oracle network token Chainlink broke below $12 on Monday, as the broader crypto market pullback outweighed anticipation for the token’s debut in a US spot ETF.

The LINK token fell more than 11% in the last 24 hours, with a bearish technical outlook pointing to a breakout, CoinDesk Research’s technical analysis tool noted.

The weakness came despite news that asset manager Grayscale is set to convert its LINK closed-end trust into an ETF structure. Well-known ETF analyst Nate Geraci said the ETF could begin trading this week on NYSE Arca.

Still, traders seemed more focused on the technical failure than the regulatory milestone. An increase in volume to 7.14 million LINK, about 280% above the daily average, pushed the token below the $13.00 support level, CoinDesk Research’s technical analysis tool noted. Prices fell to $11.94, establishing a bearish structure of successive lower highs and confirming downward pressure.

The weakness also reflects broader risk sentiment in cryptocurrencies, as bitcoin fell to near $84,000 in US morning hours amid macro jitters and speculation over the Bank of Japan’s rate hike.

Key levels to consider:

- Support/Resistance: Immediate support now sits at $11.87 and resistance at $12.26, the previous breakout point.

- Volume Analysis: The volume of 7.14 million tokens marked a 280% increase above average, confirming institutional selling pressure.

- Chart Patterns: Break below the descending trend line with a decline of 11.7% in a range of $1.56.

- Targets and Risk: Further downside could target the $11.70-$11.80 area, with the November lows at $11.39 the next level to watch.

Disclaimer: Portions of this article were generated with the help of artificial intelligence tools and were reviewed by our editorial team to ensure accuracy and compliance with our standards. For more information, see CoinDesk’s full AI Policy.