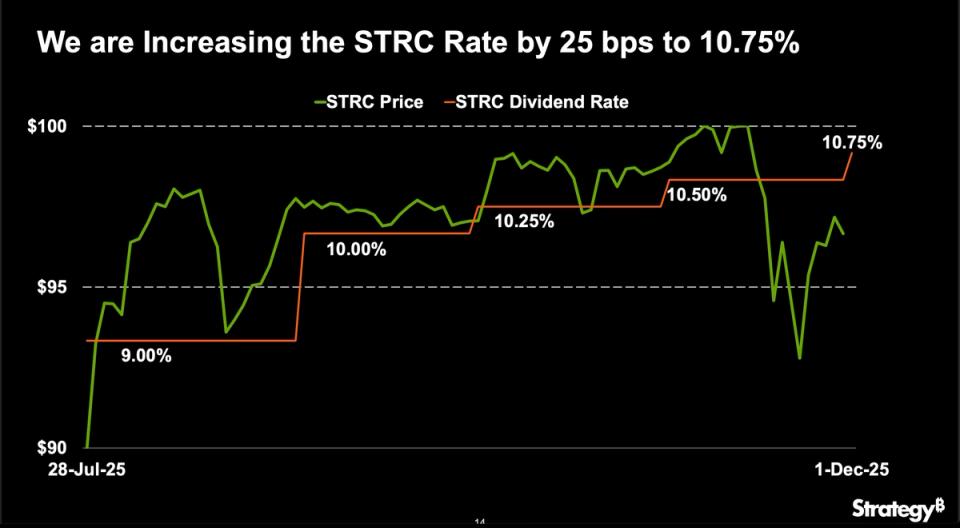

Strategy (MSTR) announced on Monday a further 25 basis point increase in the dividend rate of its STRC preferred series to 10.75%. This is the fourth increase since the IPO launch at the end of July.

One of Strategy’s perpetual preferred shares, STRC or “Stretch”, is designed to offer short duration features with high yield exposure. It currently pays an annual dividend of 10.75%, distributed monthly in cash. The dividend rate is adjusted each month to encourage trading near STRC’s $100 face value and limit price volatility.

When it launched in July, STRC initially had a 9% dividend yield at the IPO price of $90. The company then increased the dividend rate twice to 10.25%, although STRC still did not reach face value. A third rise eventually brought the price to $100, but the drop in the price of bitcoin and Strategy common stock affected STRC, which at one point in the November panic fell to around $90, setting this latest rally in motion.

STRC was trading at $98.43 at the time of this publication.

The updated dividend rate was announced alongside news of a $1.44 billion cash cushion intended to fund perpetual preferred dividends. The total annualized dividend obligation on all perpetual preferred shares is approximately $800 million. According to the investor presentation, the company has 74 years of dividend coverage compared to its $59 billion bitcoin reserve. Still, the cash reserve of $1.44 billion is expected to be the main source of dividend funding in the near term.