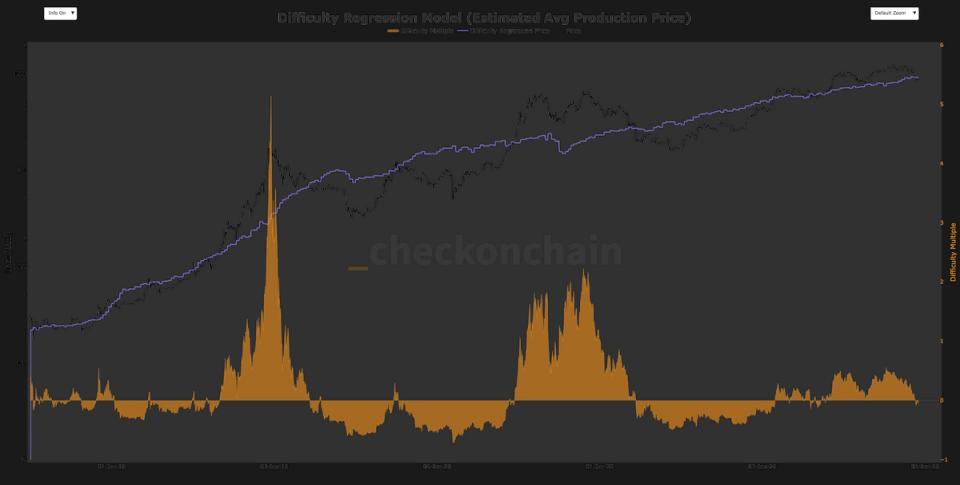

bitcoin is closely following the difficulty regression model, according to checkonchain.

This model estimates the total cost of sustained network production. The model treats mining difficulty as the distilled measure of mining price because it incorporates all major operating variables into a single figure. This provides an industry-wide estimate of the average cost of producing a bitcoin without requiring detailed assumptions about hardware, energy expenditures or logistics.

The model currently sits near $92,300, roughly matching the spot price of bitcoin. It suffered a brief drop when bitcoin fell to around $80,000, but has since recovered to the model’s valuation.

The price tends to remain in a bull market regime when trading above the model and often changes to a bear market regime when trading below it.

In April 2025, bitcoin fell to around $76,000 and rebounded precisely at the value of the model at that time, acting as an important support level. For much of 2025, it was trading at a premium of about 50% to the model, while for much of 2024 the price remained close to the model.

During the 2022 bear market, Bitcoin was trading at a discount of up to 50% from the model. Meanwhile, in previous bull markets, the multiple expanded much further: bitcoin price doubled the top model in 2021 and quintupled in 2017.

As Bitcoin has matured as an asset, premiums near those levels appear to be a thing of the past.

Overall, the model suggests that the price of Bitcoin is currently close to its cost of production, which can be interpreted as a zone of fair value. Metcalfe law valuations also place Bitcoin close to fair value, around $90,000, reinforcing that assessment.