XRP extended its rally with clear momentum through the $2,197 resistance, indicating renewed bullish momentum as institutional accumulation reappeared at key levels.

- Broader crypto sentiment improved as BlackRock reiterated its support for real-world asset tokenization issues.

- Firelight, a new DeFi protocol, allows XRP holders to stake tokens and earn rewards while providing on-chain protection against attacks.

- Created by Sentora and backed by Flare Network, Firelight introduces a capital-efficient protection layer to improve DeFi resilience.

- The protocol uses Flare’s FAssets system to integrate XRP into DeFi, offering a new yield earning opportunity for XRP holders.Technical Analysis

- The achievement allows FSRA-licensed companies to use RLUSD for regulated activities, expanding their presence in the Middle East.

- The acceptance of RLUSD on ADGM highlights its role as a stable currency with clear reserve rules, which attracts banks and payments companies in the region.

Technical analysis

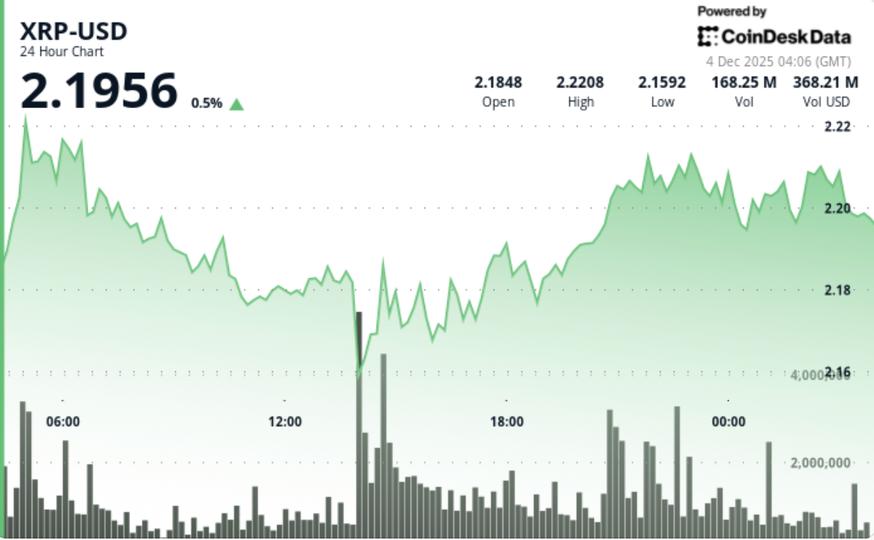

- XRP’s move above $2,197 confirms a clear breakout of the microrange that contained the price action for most of the previous session.

- Repeated defenses of the $2.17 channel floor illustrate the absorption of demand at lower levels. This activity occurred alongside elevated funding rates, which rose more than 120% in the last 24 hours. While this reflects growing bullish conviction, it also indicates increasing leverage risk should the price fail to deliver.

- The broader structure remains intact: an intraday breakout setup, rising channel support from the November lows, and a developing Power of 3 progression that suggests accumulation, manipulation, and expansion. XRP is currently in the transition zone between the second and third phase.

XRP traded between $2.19 and $2.20 for most of the session before a brief liquidity sweep took the price to $2.15 during the day’s highest volume event. Buyers immediately absorbed the move, sending the token back above $2.17 and holding higher lows on each subsequent retest.

The break through $2.197 triggered a clean move to $2.206, supported by hourly volume increasing from $450,000 to $553,000. The price stabilized above $2.204 at the close, while $2.22 emerged as the next resistance level to be breached.

Intraday momentum remained constructive, although bullish continuation now depends on maintaining structure above $2.204 and avoiding deeper tests of $2.17.

• The micro-support at $2,204 is now the immediate pivot: staying above it keeps the breakout active.

• A break above $2.22 opens a direct continuation towards the $2.33 to $2.40 resistance band.

• Rejection of $2.22 combined with rising funding rates increases risk of increased leverage

• Losing $2.17 would shift attention back to the broader psychological level of $2.00

• Volume confirmation remains key: sustained impressions above 600,000/hour would support another leg of expansion