Meme coin breaks key technical level as institutional-sized trades dominate Wednesday session amid ETF filing rumors.

News background

- Dogecoin’s decline came despite an increase in network activity and renewed ETF speculation.

- Both 21Shares and Grayscale filed advanced filings for spot DOGE ETFs, adding to expectations that meme coins could see broader institutional availability in the coming months.

- On-chain metrics also recorded a notable change: DOGE recorded 71,589 active addresses (the highest level since September), indicating growing user participation even as the price action weakened.

- However, this fundamental context failed to support the market. Whale activity remains subdued compared to November, and ETF inflows have not accelerated significantly, creating a divergence between growing network participation and weakening price structure.

- As broader crypto sentiment skews risk aversion, DOGE’s technical stance has overshadowed its improving on-chain footprint.

Technical analysis

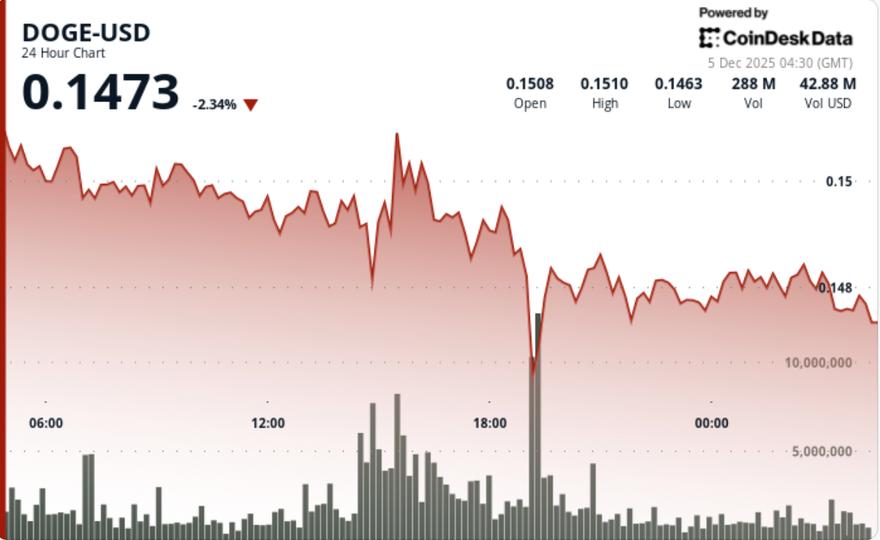

- The break was clean, decisive and clearly driven by institutional or algorithmic flows. DOGE’s failure to hold support at $0.1487 came after three failed tests of the $0.1522 resistance band, each marked by declining bullish volume, a classic warning sign of weakening buyer conviction.

- Once sellers broke the $0.1487 floor, volume increased dramatically, with three consecutive hourly candles surpassing 400 million tokens traded, confirming that big players were unwinding rather than retail traders capitulating.

- The price action formed a descending triangle, with lower highs squeezing directly into a flat support zone.

- The eventual breakdown aligns with this structure and suggests a continuation unless buyers reclaim the $0.1487 to $0.1510 region.

- Despite the increase in active addresses, neither momentum indicators nor volume signatures point to an imminent reversal.

- The RSI continues to fall, while trend following signals remain bearish. Until DOGE recovers to at least $0.1487, sellers retain the positional advantage.

Price Action Summary

DOGE fell from $0.1522 to $0.1477 throughout the session, marking a 3% drop within a tight range of $0.0070.

The failure occurred at maximum volume, with 830.7 million DOGE tradedrepresenting 174% above the 24-hour average.

Attempts to rally towards $0.1483 were immediately sold off, and volume spikes of 14.4 million were repeatedly rejected. The current consolidation remains shallow at best and the price continues to oscillate within the lower band of the breakout zone.

What traders should know

- DOGE is now in a weak position, with technicals outweighing ETF optimism and on-chain improvements.

- Support at $0.1470 is the next critical level; a clear breakout risks continuing towards $0.1450 and potentially $0.1425 if volume remains high.

- For the bulls, the path is clear but challenging: a recovery of $0.1487 is necessary to neutralize the breakout, while a move above $0.1510 would be the first legitimate sign of a trend reversal.

- Until then, the market favors a bearish bias as large traders continue to distribute towards any intraday strengths.