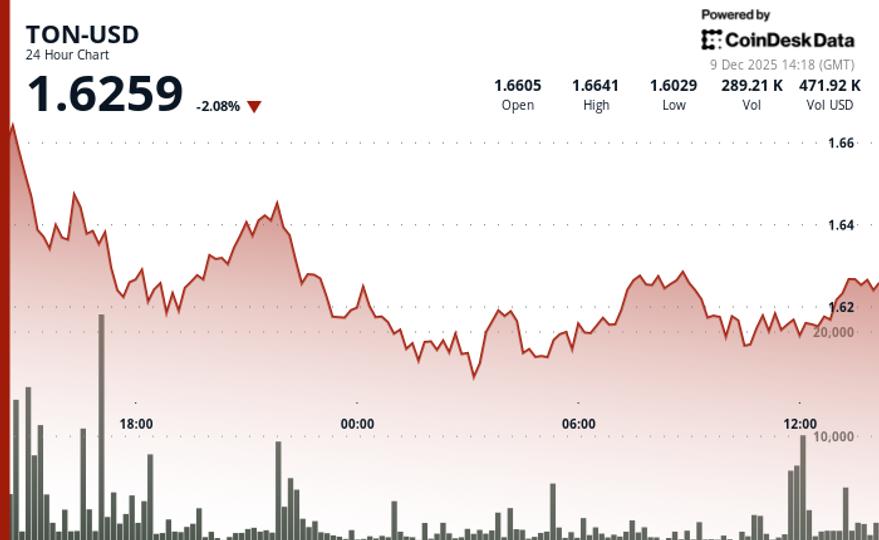

lost ground in the last 24 hours, falling more than 2% to $1,625 as selling pressure sent the token down to now record a drop of nearly 72% in the last 12 months.

The move came amid a failed breakout near $1,668, with the slowdown forging a clear downtrend pattern of lower highs and lower lows in a tight range.

Trading volume during the settlement soared to 3.02 million TON, a 43% increase above the daily average, according to CoinDesk Research’s technical analysis data model. That increase in activity coincided with a drop below key support levels, further weakening sentiment.

However, TON price action found a bottom at $1.6025. Multiple tests of that support held firm as volume declined, indicating that aggressive selling had cooled.

Most notably, a possible change in momentum occurred in the final hours of trading. The price rose back above $1,620 on increased volume, forming an ascending pattern of higher lows that often points to systematic buying.

TON is now at a technical crossroads. A push above $1,635 could confirm the reversal, while a drop below $1,602 would reopen the downside risk. Traders watching the $1,620 pivot will likely treat it as a decisive level to determine if this bounce turns into a broader trend reversal.

Disclaimer: Portions of this article were generated with the help of artificial intelligence tools and were reviewed by our editorial team to ensure accuracy and compliance with our standards. For more information, see CoinDesk’s full AI Policy.