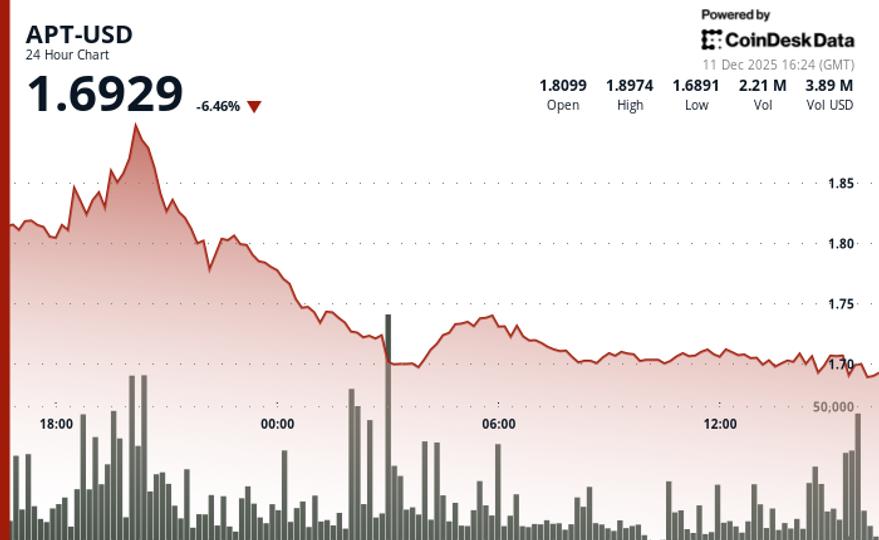

declined 7% in the last 24 hours as investors repositioned ahead of the token’s scheduled unlock.

The broader crypto markets also fell, with the CoinDesk 20 index down 4.2% at press time, according to CoinDesk Research’s technical analysis model.

Volume surged 38% above the 30-day average as APT retreated from an initial peak of $1.90, where exceptional trading reached 6.81 million tokens, nearly triple normal levels.

Selling pressure intensified as market participants positioned themselves for the scheduled unlocking of 11.3 million APT tokens, representing 1.5% of the total supply flowing to core contributors and early investors.

Technical weakness dominated price action following the rejection of $1.90, with APT establishing a series of lower highs and lower lows.

The token found preliminary support near current levels after testing $1.69 several times, although volume patterns suggested continued distribution by larger holders.

Technical analysis

- Main support zone established between $1.69 and $1.70 after three successful defense attempts

- Major resistance is confirmed at $1.91, where exceptional volume marked strong selling interest.

- Daily activity is 38% above the 30-day moving average, confirming institutional participation

- The peak volume of 6.81 million tokens (180% above normal) occurred with resistance at $1.90, validating the distribution.

- The descending pattern from the high of $1.90 established a short-term bearish structure with lower highs

- Breaking above $1.71 is required to challenge stronger resistance near the session high of $1.90.

- Failure of support below $1.69 could trigger the next major decline based on previous consolidation zones

Disclaimer: Portions of this article were generated with the help of artificial intelligence tools and were reviewed by our editorial team to ensure accuracy and compliance with our standards. For more information, see CoinDesk’s full AI Policy.