Dogecoin lost a critical technical level after a strong high-volume sell-off, indicating a change in the short-term market structure and forcing traders to reassess short-term risk.

News background

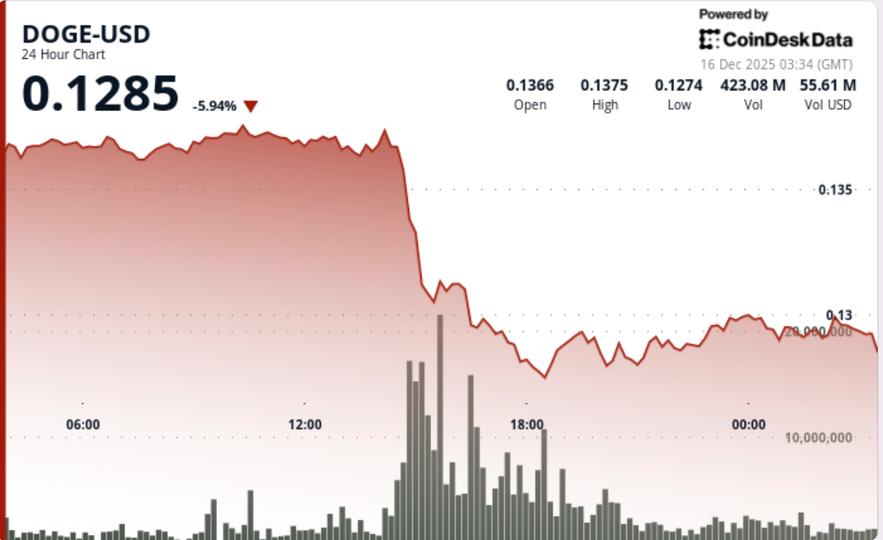

- Dogecoin fell 5.5% in the last 24 hours, falling from $0.1367 to $0.1291 as selling pressure intensified across the crypto market.

- The move came amid weaker risk sentiment and declining participation in higher beta assets, with meme tokens absorbing huge downsides relative to majors.

- While no catalyst drove the liquidation, the move coincided with a continued rotation out of speculative exposures and weaker liquidity conditions.

- DOGE remains range-bound on a higher time frame, but the latest drop represents a clear inability to defend the levels it had held during the recent consolidation.

Technical analysis

- The drop below $0.1370 marked a decisive loss of short-term trend support. Volume increased to 1.63 billion tokens during the sell-off, about 267% above average, confirming that the move was driven by large flows rather than passive drift.

- The price broke cleanly through the intermediate supports without significant pauses, indicating limited supply depth once it gave up $0.1320. Failure to recapture $0.1300 on the first bounce attempt keeps the short-term structure tilted to the downside even as momentum indicators begin to stabilize.

- Structurally, DOGE has gone from range compression to bearish expansion. Until the price regains previous support, rallies will remain corrective rather than trend reversal.

Price Action Summary

- After hitting session lows near $0.1290, DOGE began to stabilize as selling pressure eased. Subsequent candles showed reduced volume and shorter downside extensions, suggesting that selling pressure may be easing.

- Intraday price action has started to form higher lows from the $0.1290 base, but upside follow-through remains limited. Sellers continue to appear near $0.1300, keeping the price capped and confirming this level as immediate resistance.

What traders should know

- The near-term direction now depends on whether DOGE can hold above the $0.1290 to $0.1280 zone.

- A sustained acceptance below this area would expose the next support band near $0.1250, while a successful recovery of $0.1300 would be the first sign that the bearish momentum is waning.

- Volume behavior is key. Continued normalization would support a consolidation phase, while new peaks of bearish movements would suggest further distribution. For now, DOGE is in a fragile stabilization phase, where patience and confirmation matter more than anticipation.