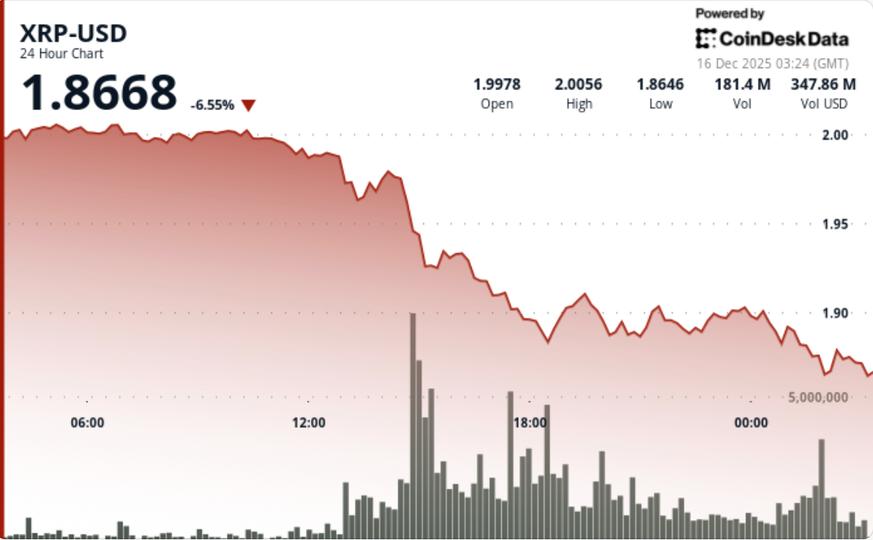

XRP lost a key technical level after a failed breakout attempt, with heavy volume confirming a shift towards near-term bearish control.

News background

XRP declined 2.6% in the past 24 hours, falling from $1.95 to $1.90 as broader crypto markets showed signs of fatigue. The move came after multiple failed attempts to maintain momentum above recent resistance, leaving XRP vulnerable once support levels were tested again.

There were no new fundamental catalysts driving the sell-off. Instead, the move developed in a technically sensitive area, where positioning had developed following previous rebound attempts. As the price stalled near resistance, selling pressure reemerged, overwhelming bids during the European trading session.

Technical analysis

The break below the $1.93 Fibonacci level marked a clear technical failure. This zone had previously acted as a pivot during the consolidation, and its loss shifts the short-term structure in favor of sellers.

Volume expanded markedly during the rejection, with turnover increasing 107% above daily averages, confirming that the move was driven by active distribution rather than low liquidity drift. The recovery attempt towards $1.95 showed initial momentum with higher highs, but the inability to hold above $1.92 triggered systematic selling to strengthen.

From a structural perspective, XRP went from range expansion to range rejection. As long as the price remains limited below the $1.93 to $1.95 zone, bullish attempts are corrective rather than trend reversal.

Price Action Summary

XRP traded through a range of $0.09 during the session, initially advancing towards $1.95 before reversing sharply. Selling intensified once the price fell back to the $1.92 to $1.94 band, and bids decreased near the lower limit.

Following the crash, XRP stabilized near $1.90, where selling pressure eased and volume began to normalize. The hourly price action shows consolidation forming just above the area between $1.88 and $1.90, although no strong reversal signals have emerged yet.

What traders should know

The $1.93 level now acts as the first major resistance. Any recovery attempt must recapture this zone with strong volume to shift momentum toward neutrality. Failure to do so keeps the risk of falls in play.

On the downside, $1.88 to $1.90 is the immediate area to watch. A sustained break below this base would expose deeper support levels, while a successful defense could allow XRP to consolidate ahead of the next directional move.

For now, volume behavior remains critical. Continued selling on rallies would confirm the ongoing distribution, while decreasing volume near support would suggest the market is moving from collapse to stabilization.