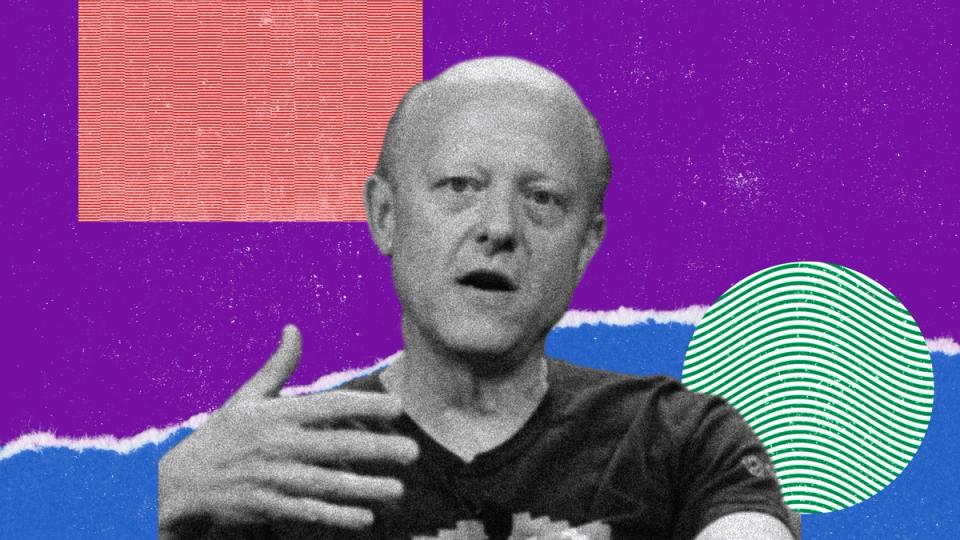

Circle (CRCL) co-founder, chairman and CEO Jeremy Allaire spent 2025 turning a long-standing thesis – that dollar-backed digital money would become a core financial infrastructure – into a widespread political and technological agenda.

This feature is part of CoinDesk List of the most influential of 2025.

Allaire seems proud of the strong regulatory foundation for his company’s fiat-backed stablecoin, USD Coin (USDC), which is the second-largest stablecoin by market capitalization. during a February 25 interview with Bloomberg, in a thinly veiled attack on rival Tether’s stablecoin. said: “It shouldn’t be a free pass, right? Where you can just ignore American law and do whatever you want anywhere and sell in the United States.”

“This is about consumer protection and financial integrity,” Allaire continued. “Whether you are an offshore company or based in Hong Kong, if you want to offer your dollar stablecoin in the US, you have to register in the US, just like we have to register anywhere else.”

Allaire’s advocacy in Washington helped build momentum behind the Guiding and Establishing National Innovation for US Stablecoins Act, or GENIUS Act, the first federal law establishing licensing and reserve standards for payment stablecoins, which passed the US Senate on June 17 and the House on July 17 before being signed into law by President Trump on July 18.

On June 30, in a Circle press release announcing the company’s submission of an application to the Office of the Comptroller of the Currency (OCC) to establish a national trust bank, the First National Digital Currency Bank, NA, Allaire said: “The establishment of such a national digital currency trust bank marks an important milestone in our goal to build an Internet financial system that is transparent, efficient and accessible.”

In the fall, Allaire’s strategic focus was on Arc, the institutional blockchain Circle pitched as a foundation for regulated, dollar-denominated financial activity.

In late October, while speaking with CNBC’s Sara Eisen at the Future Investment Initiative in Riyadh, Saudi Arabia, he described Arc as “an economic operating system for the Internet,” built for payments, foreign exchange, lending and capital markets workflows with sub-second settlements, privacy controls and predictable dollar fees.

He said demand for USDC in emerging markets was “very significant”, highlighting the Middle East, and noted that more than 100 banking, payments, technology and artificial intelligence companies were testing Arc’s public testnet on October 28 ahead of the mainnet launch planned for 2026.

Allaire closed the year by expanding the framework even further.

In a Dec. 4 conversation with WIRED’s Steven Levy, he called blockchain networks “economic OS paradigms” and said the shift to programmable financial systems would be “a big part of what’s going to develop on the Internet in the next five to ten years.”

His influence in 2025 was based on more than just products or political victories. He emerged from articulating a coherent vision for digital dollars, embracing federal oversight, and driving an institutional blockchain agenda, making him one of the central figures that will shape how programmable finance will operate in the years to come.