XRP plunged after a multi-day consolidation on Saturday night, falling below the $1.93 support zone as high volume confirmed sellers were in control even as broader crypto markets remained mixed.

News background

- The move comes amid a broader cooling of risk appetite in cryptocurrencies, with Bitcoin struggling to sustain recent rebounds and large-cap altcoins experiencing selective pressure rather than broad capitulation.

- Analysts have noted that XRP, in particular, has been vulnerable since losing the $2.00 level earlier this month, with repeated bounces failing to attract sustained follow-through.

- On-chain data from Glassnode shows that below $1.77, realized supply narrows significantly to the $0.80 area, a level that previously marked heavy accumulation during previous cycles.

- While that remains a longer-term scenario, the loss of intermediate support has increased sensitivity to downside extensions.

Technical analysis

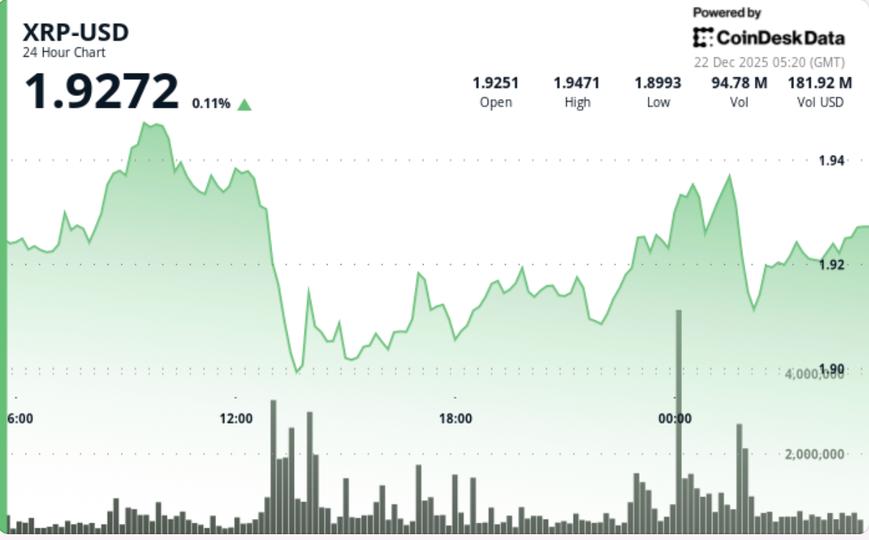

- XRP spent most of the session trading within a range of $1.90 to $1.95 before sellers forced a break through the lower boundary.

- The $1.93 area, which had acted as support through multiple tests, gave way during US hours as volume expanded well above recent averages.

- The most decisive move came around 13:00 UTC, when the price fell to $1,897 on a volume of about 93.8 million tokens, about 78% above the 24-hour average.

- That move turned the former support zone into resistance and confirmed a failure of the previous consolidation structure.

- On the hourly chart, XRP is now trading below its short-term moving averages, and momentum indicators are shifting rather than showing divergence. The inability to recover $1.93 quickly keeps the short-term bias tilted to the downside.

Price Action Summary

- XRP fell from $1,926 to $1,915 during the 24-hour period ending December 22 at 02:00 UTC

- The price briefly rose to $1.95 early in the session before reversing sharply.

- A late session push lower saw XRP fall to $1,907 over the past hour.

- Volume accelerated during the crisis rather than fading, suggesting active selling rather than low liquidity.

Despite some buying on dips near $1.90, the bounces lacked momentum and the price failed to re-enter the previous range.

What traders should know

- Between 1.93 and 1.95 dollars now acts as a resistance band after the collapse

- $1.90 is the first level that bulls must defend to avoid further selling

- A clear loss of $1.77 would expose a much thinner demand zone down to around $0.80, according to on-chain cost data.

- Any recovery attempt needs a quick recovery to $1.93 with increasing volume to neutralize the current setup.

For now, XRP remains in a technically fragile position, with sellers controlling rallies and buyers showing limited conviction at higher levels.