Dogecoin moved lower during the session on Sunday after failing to hold short-term support, and elevated volume suggests sellers are regaining control as the price moves toward the lower end of its recent range.

Market Overview

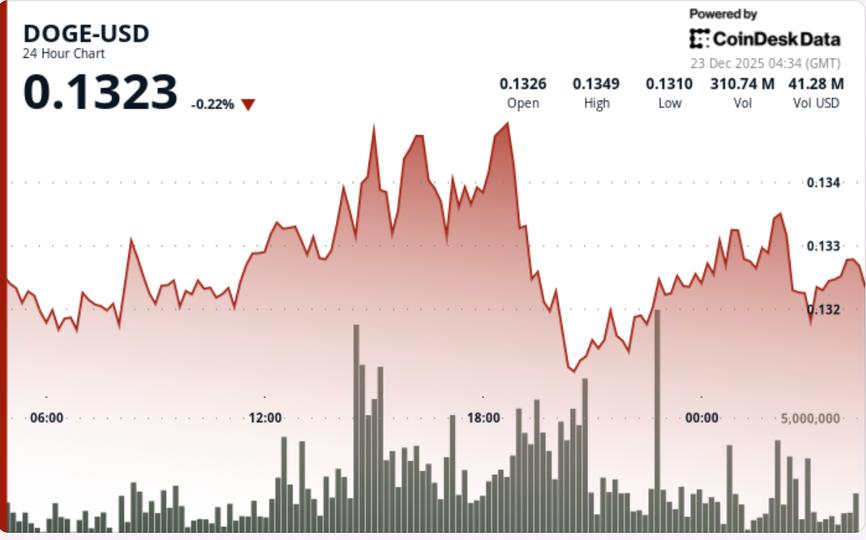

DOGE fell around 1.8% in the last 24 hours, going from an intraday high near $0.1341 to trading around $0.1323. The move came after a failed recovery attempt above $0.135, where selling pressure re-emerged and limited bullish momentum.

Business activity recovered markedly during the fall. Volume increased to approximately 721 million tokens around the session peak, approximately 150% above the 24-hour average, indicating active repositioning rather than thin, low-liquidity price movement.

Technical analysis

The key technical development was DOGE’s loss of support near $0.1320, a level it had held during several previous pullbacks. Once that area gave way, price dropped towards session lows with limited follow-on buying.

On intraday charts, DOGE also fell below the lower boundary of a short-term ascending channel, confirming a move away from the modest recovery structure that had formed late last week. The rejection near $0.1352 established a lower high, reinforcing the short-term bearish bias.

Price Action Summary

- DOGE Failed to Hold Gains Above $0.135, Finding Selling Interest at Resistance

- Volume increased sharply during rejection, pointing to distribution

- The price fell below $0.1320, a level that had acted as short-term support.

- Trading at the end of the session stabilized near $0.1323, but without a strong rebound

Overall, the price action reflected controlled selling rather than panic, although momentum remains tilted to the downside.

What traders should keep in mind

With $0.1320 now acting as overhead resistance, attention turns to whether DOGE can stabilize above the next demand area near $0.1280-$0.1290. That zone aligns with previous consolidation and could attract buying interest on dips if selling pressure eases.

On the upside, DOGE would need to reclaim $0.1320 and then $0.1350 to neutralize the current bearish structure. Until then, rallies are likely to be met by bids from traders looking to exit their positions strongly.

For now, DOGE remains in a fragile technical position, and the price action suggests a bearish consolidation pattern rather than a confirmed reversal.