XRP fell to $1.86 as traders continued to sell on rallies, even as spot demand for ETFs remained stable and total assets held by ETFs rose to $1.25 billion, a gap that suggests the market is still digesting supply at key technical levels.

News background

Institutional appetite for XRP exposure continued to increase across exchange-traded funds, with investors adding $8.19 million in recent sessions. That raised total net assets held by ETFs to $1.25 billion, reinforcing the idea that professional investors are building positions through regulated vehicles rather than chasing spot momentum.

The flow trend fits a broader pattern in institutional cryptocurrency allocation: Portfolio managers increasingly prefer structured products that reduce custody and compliance friction, especially when liquidity is deep and regulatory clarity is improving. XRP’s depth across the board and steady ETF supply have kept long-term demand intact, even as short-term price action remains choppy.

In the broader market, bitcoin’s attempted rebound went untracked during US time, leaving large companies trapped in a risk-averse, range-bound treadmill where flows matter but technical levels still dictate daily trading.

Technical analysis

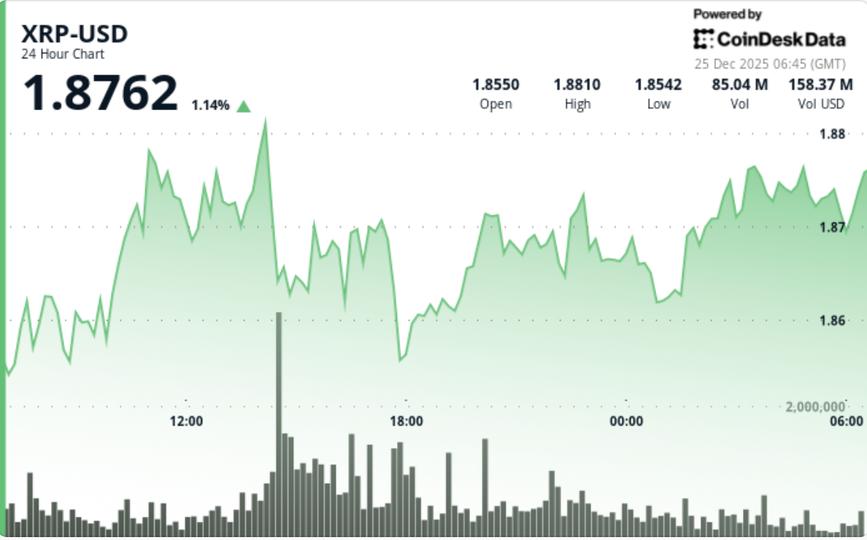

XRP fell from $1.88 to $1.86, remaining stuck within a $1.85 to $1.91 channel as sellers repeatedly defended the $1.9060 to $1.9100 resistance area. Volume increased sharply during the most active window of the session, with 75.3 million changing hands (about 76% above average) during the rejection, underscoring that this is not a low liquidity drift. It is a market that finds real offers above.

Price briefly broke out of its $1,854-$1,858 consolidation pocket and tested $1,862 in a burst of activity that spiked roughly 8-9 times compared to typical intraday flow. But the move lacked persistence and XRP turned back towards $1.86 as supply returned.

The repeated defense of $1.90+ suggests that sellers are still using that zone to distribute strength. At the same time, bids near $1.86-$1.87 have proven consistent enough to prevent the market from unraveling, creating a spiral of tension where the next breakout is likely decisive.

Price Action Summary

- XRP fell from $1.8783 to $1.8604, remaining locked in a range of $1.85 to $1.91

- The strongest selling response came near the $1.9061 resistance with above-average volume.

- The bulls held the $1.86 level in multiple tests, limiting downward follow-through.

- A short-lived breakout above the previous consolidation level failed to become a sustained move

What traders should know

Two forces are competing, and that’s the story: ETF flows remain favorable at the bottom, but short-term traders are still treating the level between $1.90 and $1.91 as a sell zone.

The levels are clear:

- If $1.87 holds and XRP can recover between $1.875 and $1.88, the next test is the heavy supply group between $1.90 and $1.91. A close above that level would force short covering and push the price towards $1.95-$2.00.

- If $1.86 fails, the market will likely slide into the next demand zone, between $1.77 and $1.80, where previous buyers have historically defended themselves and where “fear” sentiment tends to peak.

For now, the tape reads as a consolidation with distribution overheads, but with ETF flows acting as a stabilizer that could make downside moves sharper than a free fall, unless Bitcoin takes a sharp drop again.