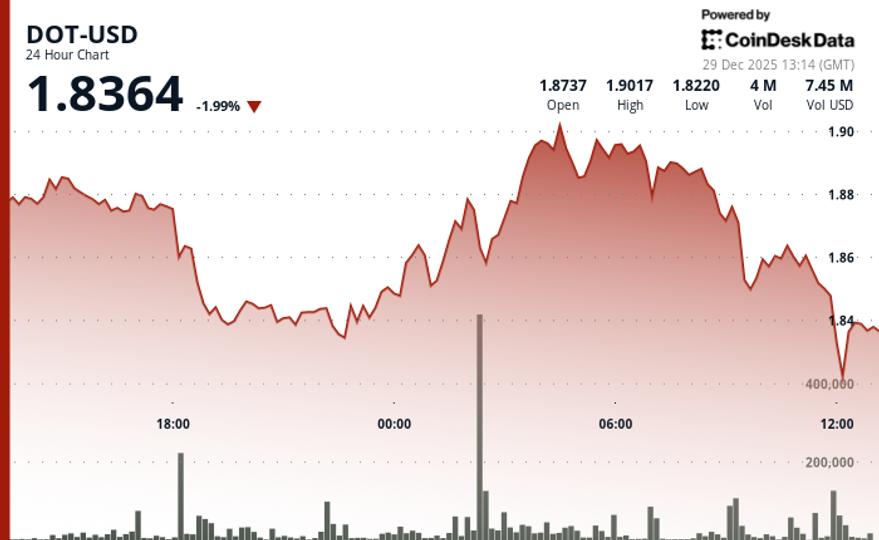

fell 2% to $1.84 in the last 24 hours.

Trading volumes were 7.8% above the seven-day moving average at 7.76 million tokens, according to CoinDesk Research’s technical analysis model.

The model showed that the DOT move occurred without clear fundamental catalysts as technical factors dominated the price action.

The token underperformed the broader crypto market. The CoinDesk 20 index was 0.6% lower at press time.

According to the model, this modest divergence reflects sector rotation dynamics rather than a fundamental weakness in Polkadot’s positioning.

In the absence of clear fundamental drivers, technical resistance at $1.88 became paramount, according to the model, as DOT worked through a volatile consolidation pattern.

Technical analysis:

- Primary resistance lies at $1.88 with selling pressure confirmed at this level.

- Support base was tested at $1.83, immediate support now lies in the $1.825-$1.830 zone

- Bullish Targets Identified Between $2.00 and $2.50 Based on Structural Breakout Patterns

- 24-hour volume averaged 7.8% above the seven-day moving average, indicating organic discovery

- Higher lows formed from a base of $1.83 during the initial consolidation phase

- Short Liquidation Levels Above $2.00 Provide Potential Bullish Catalyst

- Immediate downside risk at $1,825-$1,830 support zone requires vigilance

Disclaimer: Portions of this article were generated with the help of artificial intelligence tools and were reviewed by our editorial team to ensure accuracy and compliance with our standards. For more information, see CoinDesk’s full AI Policy.