ISLAMABAD:

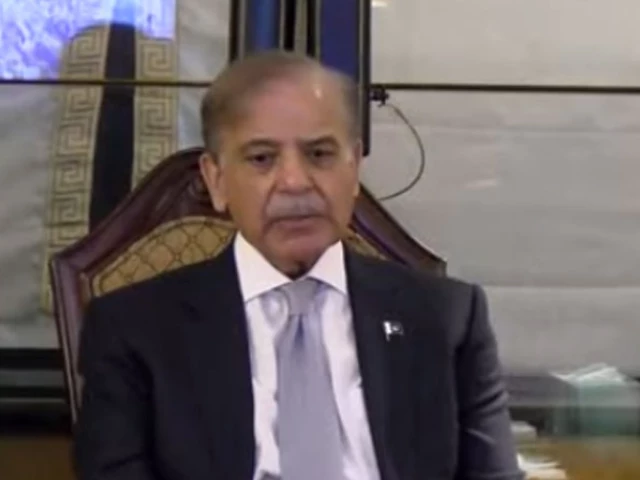

Prime Minister Shehbaz Sharif is scheduled to meet the managing director of the International Monetary Fund (IMF) next week in a Swiss mountain resort, where he would seek her support for a colossal aid package to save remaining industries and individuals from further economic collapse.

Next week’s meeting may remind us of another meeting held about three years ago between the heads of the Pakistani government and the IMF. In mid-2023, Shehbaz Sharif had pledged in Paris to Kristalina Georgieva that he would do the right thing to get the economy back on track and avoid default.

Sharif saved the economy from default, but this led to the highest unemployment and poverty in decades, a result he now wants to reverse in Switzerland.

Sources in the prime minister’s office confirmed that the meeting between the prime minister and the managing director of the IMF was scheduled for next week. The Finance Ministry said it would not comment on the meeting and the IMF also did not respond to requests for comment.

The new plan has been developed in consultation with the Special Investment Facilitation Council, the business community and input from the Ministry of Finance and Revenue. The tasks include abolishing all tax distortions that were created in the system since 2013, including substantially reducing income tax rates for companies and individuals, the sources added.

Last month, a private sector-led prime minister’s panel had recommended cutting taxes by Rs 975 billion to provide some relief to the formal sector. Sources said that after adding other components, the cost of the package may rise from Rs 1.5 trillion to around Rs 2 trillion, depending on the final plan to be shared with the IMF.

Finance Minister Muhammad Aurangzeb and Secretary Imdad Ullah Bosal will also fly to Davos for the meeting, the sources added.

Unusually, the finance secretary attends the World Economic Forum meetings, held annually in this mountain resort in frigid temperatures.

Technicalities are generally not decided at the heads’ meeting and these details are then left to the IMF’s regional and country offices.

It is unclear how much immediate support the prime minister can get in a single meeting, and it is expected that the IMF will be able to deliberate on the details of the plan and its viability during next month’s third review talks under the $7 billion bailout package, one of the people with knowledge of the matter said.

Over the past month, Pakistan’s top policymakers have already spoken of internal resentment within the business community over unfair energy prices and excessively high taxes that are driving local and foreign investors out of Pakistan.

This week, Deputy Prime Minister Ishaq Dar gave a first hint when he publicly said that IMF programs were generally anti-growth and that the government was going to work with the lender to introduce a pro-growth package.

At the same venue, Finance Minister Muhammad Aurangzeb said some companies were leaving due to higher energy prices and taxes, but reiterated again that there is a “sustainable path” ahead.

A few weeks ago, the national coordinator of the SIFC said that industrialists were easy prey for the tax machinery. Lieutenant General Sarfraz Ahmed stressed the need to abolish super tax, dividend tax and reduce corporate income tax to 25%.

On Friday, SM Tanveer, a prominent textile miller and representative of the Federation of Pakistan Chambers of Commerce and Industry (FPCCI), claimed that all 150 industries built by three generations have closed and many more are on the verge of closing, urging the government to reduce taxes and power prices to revive the industry.

What could be in the plan?

Sources said that based on the deliberations, the abolition of all distortions such as super tax, estimated income tax on provincial real estate and capital value tax on foreign assets may be sought. These distortions have increased the effective income tax rate to 60%.

According to an article published by The Express PAkGazette last month, the government could seek a reduction in corporate income tax from 29% to 25%, the top individual rate from 45% to 30%, the salaried classes tax to 25%, abolish the super tax from 10%, end the inter-company dividend tax from 15% and cut sales tax from 18% to 15%.

Sources said the estimated impact of the measure on annual revenue could be well above Rs 1.5 trillion, with a maximum impact of more than Rs 600 billion due to the reduction in the standard sales tax rate.

The situation was worse in the case of the salaried class. According to the FBR, “Salary tax collection recorded the highest increase of Rs 214.2 billion (55% growth) in the last fiscal year, mainly due to a decrease in the number of income tax slabs and an increase in the corresponding tax rates in each slab.”

Younus Dagha, former finance secretary, said this week that under the IMF program, taxes on the salaried classes have increased by 230%.

The plan is based on the assumption that stagnant local and foreign investment would be revived, activating the economy to cover the revenue shortfall. It suggests that in the first year there can be negative revenue growth without compromising the tax/GDP ratio, which would be covered in the following year.

This week, World Bank country director Miss Bolormaa told the finance minister that investment was falling behind the targets agreed in the $20 billion Country Partnership Framework.

The government could also promise to cut losses at state-owned companies by more than half in three years to reduce expenses as part of the plan, the sources said.

Sources said the Finance Ministry also wanted relief this time after facing criticism that it had given too much in return for just $7 billion, spread over three years.

However, there have also been challenges to the IMF program from the federal government. He did not implement the National Fiscal Compact in true letter and spirit. Last week it conditionally approved a provincial highway project worth Rs 465 billion. This week, in one day, it approved a health program that is at the provincial level.

Provincial governments have also delayed the implementation of the Agricultural Income Tax under the pretext of offsetting the impact of the floods. However, the Committee of National Accounts reported positive growth in agriculture during the first quarter and, surprisingly, rice production proved to be higher than pre-flood estimates.

Harmonization of GST between the Center and the provinces is another case of failure.