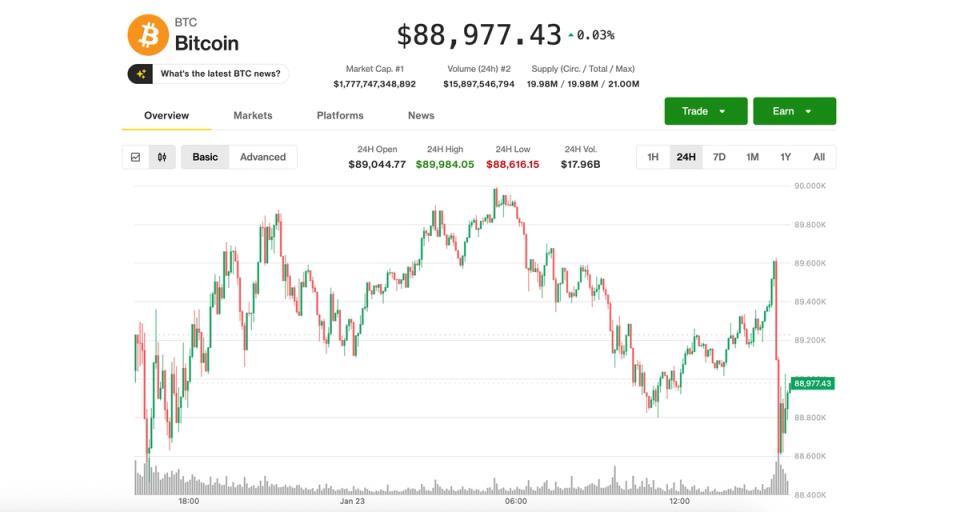

bitcoin Friday once again began the US session with a strong move lower, falling back to $88,500, even as precious metals continued their dizzying rallies, with silver topping $100 per ounce for the first time in history. Gold was just shy of $5,000 an ounce, while platinum soared 5% to a new all-time high. It’s not a precious metal, but perhaps it soon will be. At this rate, copper rose 2.5%, just below an all-time high.

Cryptocurrency-related stocks also fell. Coinbase (COIN) was down 2.6%, while Strategy (MSTR) was down 1.2%. Bitcoin miners Riot Platforms (RIOT) and MARA Holdings (MARA) recorded drops of 2%.

The cryptocurrency drop also came as U.S. stocks shrugged off early losses to mostly rise, with the Nasdaq gaining 0.4% despite a 15% post-earnings drop in Intel (INTC).

The company beat earnings expectations for the fourth quarter but disappointed with guidance for the first quarter, partly due to supply constraints for AI chips. The stock is still up 17% year to date.

US Bitcoin Yields Plunge

When Bitcoin hit $98,000 last week, cumulative returns this year during US trading sessions reached 9%, noted CoinDesk senior analyst James Van Straten. Those yields have since fallen to just 2%, underscoring weaker demand for BTC from US investors. That coincided with strong outflows from U.S. spot bitcoin ETFs, with investors withdrawing more than $1.6 billion in the past four sessions.

Jasper De Maere, desktop strategist at cryptocurrency trading firm Wintermute, noted a recent surge in stablecoin-to-fiat swaps, indicating that some institutional players who had re-entered the market earlier this year may now be taking a step back.