- Cloud services sold outside India will not be taxed, but local resellers will be taxed.

- Google, Microsoft and Amazon have committed billions by 2030

- India wants to become a developed nation by 2047, data centers will create jobs

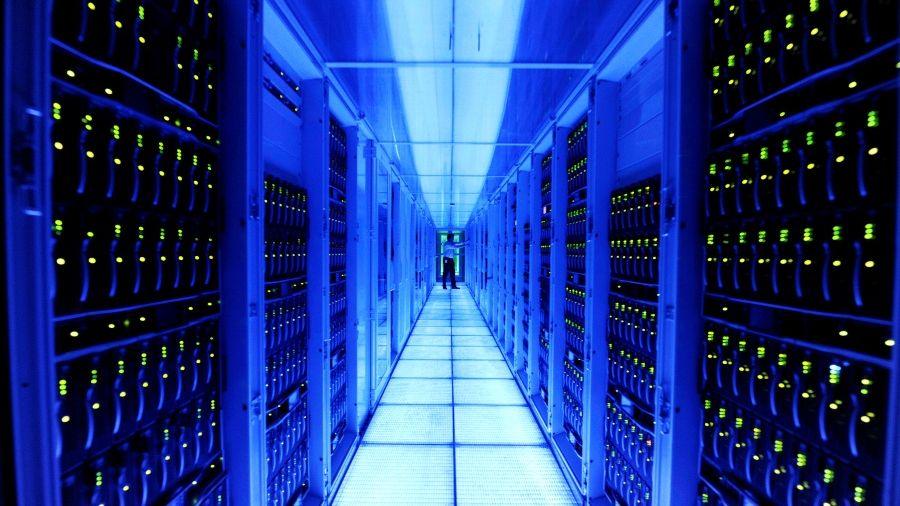

India is set to offer a major new tax incentive to attract AI cloud investments in the country, with the nation’s government confirming that no taxes will be collected on revenue from cloud services sold abroad until 2047, as long as the workloads are run from Indian data centers.

The policy was announced by Finance Minister Nirmala Sitharaman in a bid to boost the Indian economy by positioning data centers as a strategic industry rather than simply back-end infrastructure.

The hope is that the tax incentive will prompt more foreign companies to set up bases in India, creating more jobs and positioning India as a global data center hub.

India wants foreign cloud companies to set up tax-free

The policy change reflects part of an ongoing trend in which big tech companies have already committed to spending billions developing data centers in India.

This includes Google, which has pledged $15 billion by 2030, Microsoft pledged $17.5 billion by 2029, and Amazon said it would spend $35 billion by 2030, all to improve artificial intelligence and data center infrastructure.

More importantly, the incentive applies to foreign companies and domestic sales must be made through locally incorporated resellers who pay taxes as per normal Indian customs.

However, big investments will need to go into much more than just campus infrastructure, especially with tax-free breaks. Critics are concerned about erratic power supply, high electricity costs and water shortages, not to mention the impacts that high data center usage will have on local communities.

The 21-year timeline of the tax incentive is important because Prime Minister Narendra Modi has set targets for the country to become a developed nation by 2047, a plan called Viksit Bharat (developed India) (via PMIndia).

Follow TechRadar on Google News and add us as a preferred source to receive news, reviews and opinions from our experts in your feeds. Be sure to click the Follow button!

And of course you can also follow TechRadar on TikTok for news, reviews, unboxings in video form and receive regular updates from us on WhatsApp also.