DOGE fell sharply as sellers pushed the price through multiple support levels, with an increase in derivatives activity indicating speculation rather than conviction buying.

News background

- Dogecoin fell alongside broader crypto weakness, acting as a high beta proxy as ether fell roughly 7% over the same period.

- The move was not driven by specific DOGE news, but by risk-averse positioning weighing on speculative assets.

- Macro sentiment remained mixed even as U.S. lawmakers narrowly approved a funding bill to end the partial government shutdown, removing some near-term uncertainty but doing little to improve risk appetite in crypto markets.

Price Action Summary

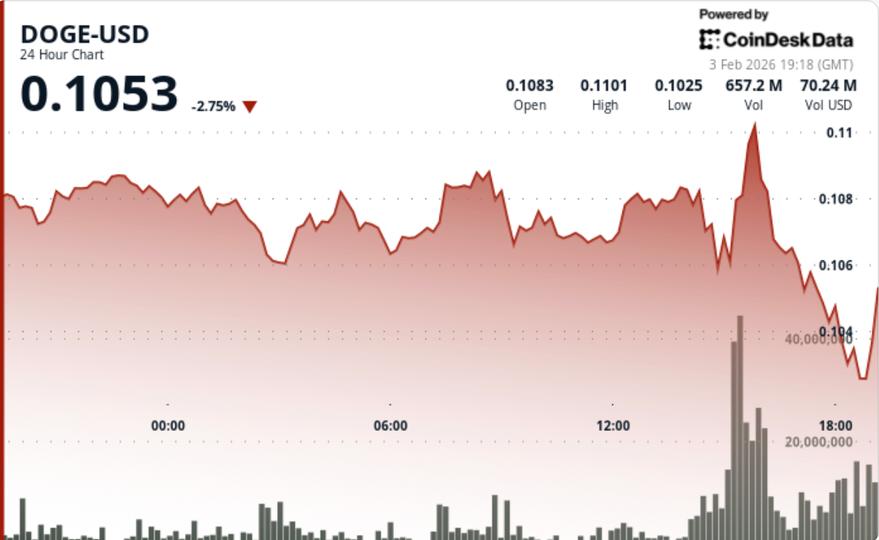

- DOGE fell 6.9%sliding from $0.1085 to $0.1030

- Multiple support levels failed during the decline

- A sharp increase in volume near $0.110 marked a failed breakout and reversal

- The price stabilized at the end of the session near $0.103–$0.104

Technical analysis

- DOGE sharply rejected near $0.110, where a large volume surge gave way to a quick reversal, turning that zone into resistance. Selling accelerated once the price fell below $0.106, confirming a distribution-driven collapse rather than a brief liquidity sweep.

- In the last hour there was capitulation-style selling in the $0.103 area, where bids finally emerged to stop the decline. While that suggests near-term stabilization, the structure remains bearish unless DOGE can regain lost support.

- A notable feature of the session was the disconnect between futures and spot: derivatives volume increased while spot trading decreased, pointing to speculative positioning rather than new demand.

What do traders say will be next?

- Traders see $0.10 as the immediate line in the sand.

- If it holds $0.10, DOGE may consolidate as sell-off pressure fades, but bulls would need a recovery to $0.106, and eventually $0.110, to argue that the sell-off has run its course.

- If the $0.10 level is broken, the downside risk opens towards $0.08, and momentum is likely to accelerate given the recent failure of multiple support levels.

- For now, DOGE remains a high beta trade, with futures activity amplifying the moves, but spot demand is needed to confirm any significant recovery.