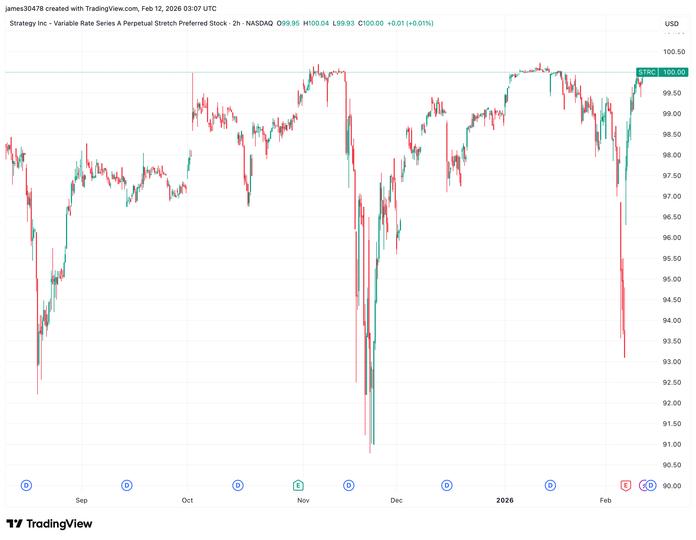

Stretch (STRC), the perpetual preferred equity issued by Strategy (MSTR), the world’s largest corporate bitcoin holder, regained its face value of $100 during the US session on Wednesday for the first time since mid-January.

Trading STRC at or above par allows the company to resume ATM offerings to fund future bitcoin acquisitions. STRC last reached the $100 level on January 16, when bitcoin was around $97,000; However, when the largest cryptocurrency by market capitalization fell to as low as $60,000 on February 5, STRC fell to a low of $93 before its recent rebound.

Positioned as a high-yield, short-duration credit instrument, STRC currently offers an annual dividend of 11.25% distributed monthly. To mitigate volatility and incentivize trading near par, Strategy resets this rate monthly and recently raised it to the current yield of 11.25%.

MSTR common stock faced pressure, falling 5% on Wednesday to close at $126, while bitcoin hovered around $67,500.