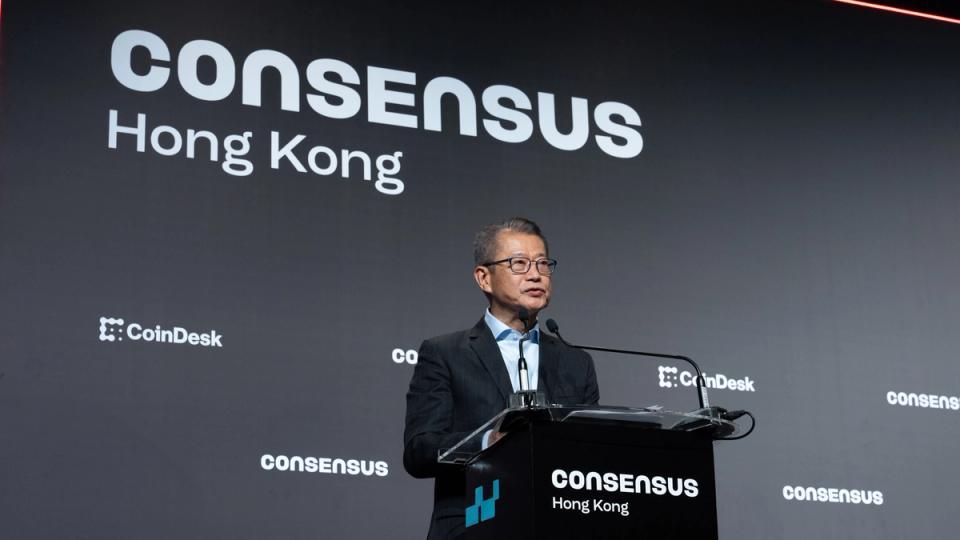

The Hong Kong consensus concluded strongly as policymakers announced new initiatives to grow the digital asset sector.

You’re reading State of Crypto, a CoinDesk newsletter that discusses the intersection of cryptocurrency and government. Click here to register for future editions.

the narrative

Policymakers at Consensus Hong Kong announced a series of initiatives aimed at strengthening the local digital asset ecosystem.

Why is it important

Philosophically speaking, the question of why we still care about this industry remains a priority. The consensus demonstrated that despite sometimes ridiculous projects and unattainable hype cycles, companies still have a genuine use for the technology.

breaking it

Hong Kong regulators are trying to encourage growth in the local digital asset ecosystem, unveiling a framework for perpetual contracts and saying stablecoin licenses will be announced next month.

“That certainty of direction gives many companies confidence to invest in Hong Kong and continue building,” said Jason Atkins, chief commercial officer at cryptocurrency trading firm Auros.

While China’s Special Administrative Region is not yet close to approving all applicants and activities, the fact that regulators such as the Securities and Futures Commission and the Hong Kong Monetary Authority are willing to get involved and adapt their approaches to digital assets remains significant, he told CoinDesk. They are asking companies what they should do to encourage investment, he said.

“We’ve been to the SFC a number of times, we’ve spoken to the HKMA about think tanks, panels and groups where they are literally trying to understand how our businesses operate and what we need to invest even more in the city, which is really positive,” he said.

Regulators have participated positively, trying to discern what companies need from them to operate in the region. This includes asking whether certain regulations need to be adjusted to address market needs, he said.

“So they think about ways to make them more flexible or lighten them for certain types of classes of investors,” he said.

This fits with a broader trend of more traditional institutions wanting to get into cryptocurrencies, or at least blockchain.

Several panelists, representing companies such as Franklin Templeton and Swift, said they were using or exploring blockchain technology to optimize their operations. This is reminiscent of the “blockchain, not Bitcoin” era of 2018, but these entities are actually running, rather than simply announcing pilots.

That an increasing number of traditional entities are migrating to blockchain may be the story of 2026, said Edge & Node CEO Rodrigo Coelho.

Companies are “rushing to figure this out,” he told CoinDesk. “Companies are looking for advice and experience.”

Singapore Gulf Bank’s Shawn Chan described these types of rails as superior for transferring value.

While international regulatory obstacles need to be overcome, he estimated that companies will increasingly adopt blockchain tools in the next decade.

This week

- Congress and federal regulators will not hold any cryptocurrency-related hearings this week.

If you have any ideas or questions about what I should discuss next week or any other comments you would like to share, please feel free to email me at [email protected] or find me on Bluesky @nikhileshde.bsky.social.

You can also join the group conversation on Telegram.

See you next week!