The FTX crash may seem like a distant memory, as bitcoin (BTC) fell to around $15,500 in November 2022. The sentiment during the period was one of extreme fear, and the industry never thought it would recover.

But just over two years later, bitcoin is trading at over $100,000 with a new, presumably cryptocurrency-friendly, US administration in charge. Donald Trump is now officially the 47th president of the US, however, he has not yet announced any crypto policies.

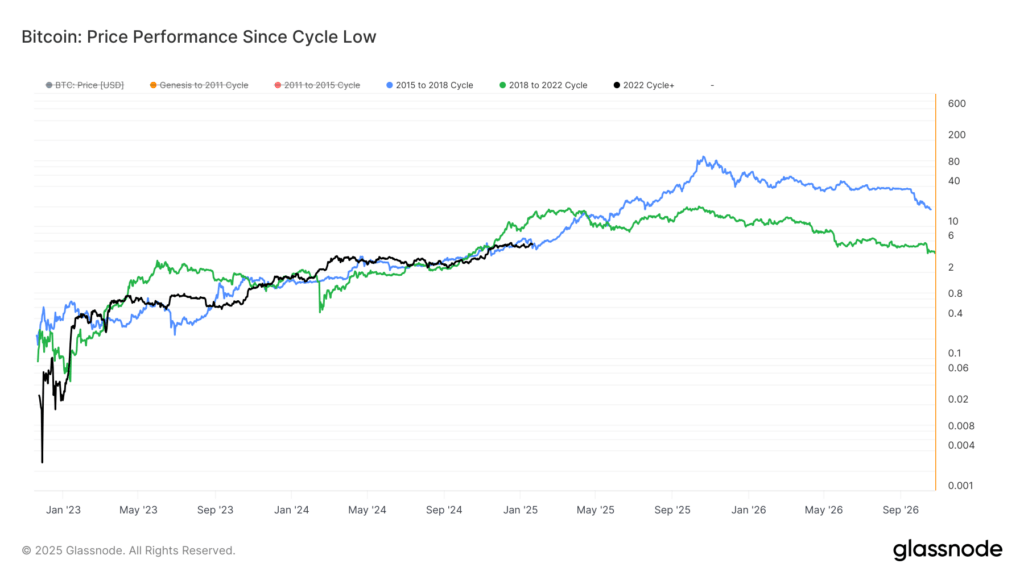

One of the many discussions surrounding bitcoin is the analysis of the four-year cycle, structured around its halving program, which cuts supply every four years. We tend to see similar cycles, with huge price appreciation the year after the halving, while the current cycle continues to mirror the previous two cycles.

So far, bitcoin is up around 550% from the cycle lows during the FTX crash (black line). The chart shows that at this point in the current cycle, between the 2015 and 2018 cycles, the price of bitcoin (blue line) also rose by approximately a similar amount from the cycle low that occurred on January 14, 2015.

It is important to note that Glassnode data takes the day’s closing price at 00:00 UTC, which may differ from other trading platforms.

The green line shows that during the 2018 to 2022 cycle, at this point in the cycle, BTC was up around 1300%, more than double the gain the token has recorded so far.

If bitcoin continues to follow the 2015 to 2018 cycle, it would end up around 1,100% higher than the cycle low at the end of the first quarter of 2025, which would put one bitcoin at $186,000. The peak of the cycle would occur around October of this year with an increase of 11,000%, which would place a maximum of the cycle at around $1.7 million.

There are many other ways to compare this to previous cycles, such as comparing it to US presidential administrations. According to a post on Bitcoin Archive’s X, bitcoin increased 20-fold during Donald Trump’s first term as president. A return of just 10x would put Bitcoin at around $1 million from here.