As expected, the United States Federal Reserve has maintained its fundamental reference Fed Range rate 4.25%-4.50%, the first pause since the Central Bank began to relieve policy last September.

The attached policy statement said the unemployment rate had stabilized a “low level” and inflation remained “somewhat high.” The writing was Awkish, since it eliminated the reference to “progress” in inflation that moved to its 2%target.

Under pressure for most of this week, the price of Bitcoin (BTC) dropped to $ 101,800 shortly after the news. The US actions were added to the losses of the day, with the Nasdaq lowering 1.1% and the S&P 500 lower by 0.9%. The dollar and gold were small and 10 -year treasure yield increased 5 basic points to 4.59%.

Since the first Rate of September of the FED, the FED fund rate has been reduced by 100 basic points. However, the 10 -year Treasury performance. UU. It has gone in the opposite direction, increasing to 4.6% of 3.6%, a divergence between short and long -term rates that has rarely seen.

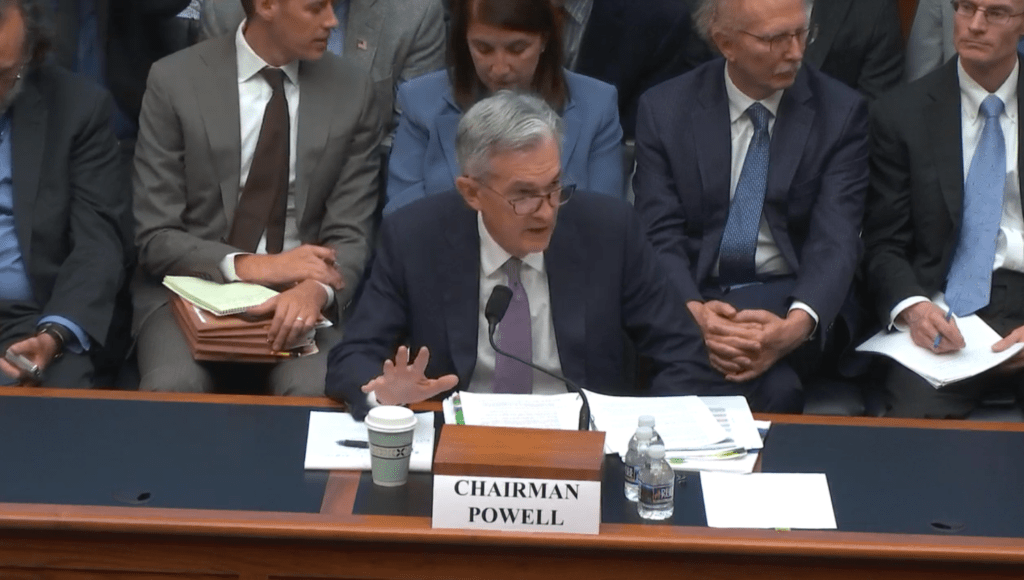

That divergence and a series of stronger reports than expected about the economy and inflation have not been lost in the Fed. After the bank meeting in December, President Jerome Powell made it clear that any additional tariff cuts, to the Less for the moment, they were waiting.

The press conference after Powell begins shortly, in which market participants will seek more guidance on future policy.