Stablecoins market capitalization has just drilled $ 200 billion, reaching a record height in a sign that the cryptography market can be ready for greater growth, according to Cryptoquant.

The stablecoins are digital tokens whose value is linked to another asset, generally the US dollar, to provide, as the name implies, a stable price. Operators use to maintain the value of their investments as a change between assets.

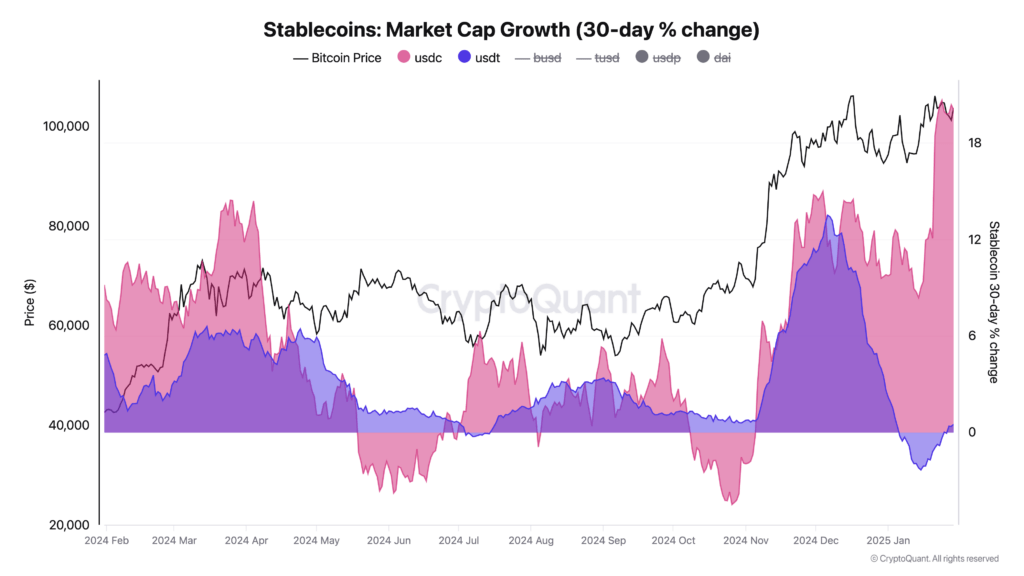

According to cryptocant data, the Stablecoin market has grown by $ 37 billion since the beginning of November, when President Donald Trump won the US elections.

“The following advantage for Bitcoin and Crypto prices could be just around the corner, since Stablecoin’s liquidity impulse begins to expand again,” Cryptoquant wrote in a report.

The Tether USDT is still the dominant Stablcoin leader, with a market limit of $ 139 billion, since it has grown 15% since November. The USDC of Circle is as follows, with $ 52.5 billion that has grown 48% during the same period, according to cryptocancy data.

The USDT liquidity change at 30 days is now slightly positive after contracting 2% at the beginning of the year. Meanwhile, the USDC liquidity change to 30 days increases 20%, the fastest rate in a year.

Bitcoin (BTC), in comparison, has risen more than 50%, and the total cryptographic market is now $ 3.5 billion of $ 2.2 billion, according to TrainingView Metric, total.