Crypto Exchange Bullish Global is considering selling actions to the public for the first time at some point for 2025, Bloomberg reported, citing people familiar with the matter.

The company, owner of Coindesk, is working with Jefferies Financial Group on the potential list, said Bloomberg.

The conversations of an initial public offer (IPO) occur when Bitcoin (BTC) prices and other cryptocurrencies have shot since Donald Trump won the US elections in November. The total cryptographic market has risen to $ 3.15 billion of $ 2.2 billion. On Tuesday, the Crypt of the United States. Uu. Sacks David Sacks spoke about a golden age for digital assets.

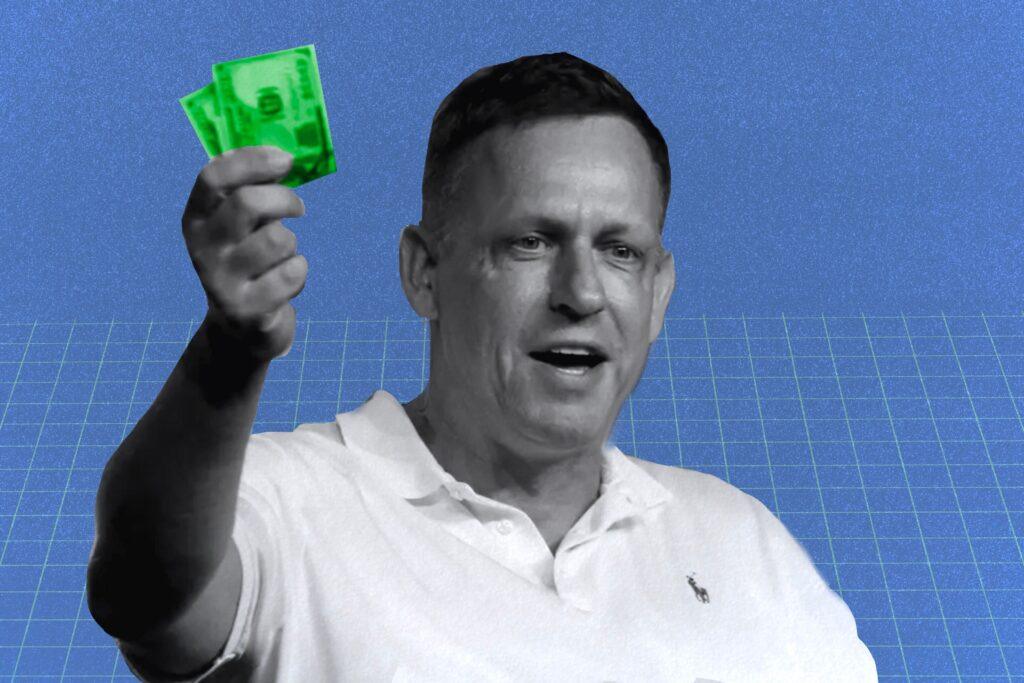

Directed by CEO Tom Farley, Bullish has more than 275 employees worldwide, including Hong Kong, the United States and Europe. It is a block subsidiary. One, a Blockchain software company headed by Brendan Blumer, whose sponsors include Peter Thiel, Alan Howard and Richard Li.

Blumer, who also serves as president of Bullish, launched the company in 2021. Bullish has about $ 10 billion in digital and effective assets, according to the report. He had planned to be public through a special purpose acquisition company (SPAC) in 2021. The plan was canceled the following year.

The Discussions about the OPI are ongoing, including additional bank partners, Bloomberg said.

Representatives of Bullish and Block. One did not respond to Bloomberg, and Jefferies declined to comment. An email from Coindesk to the Alcista search comments was not answered before the publication.