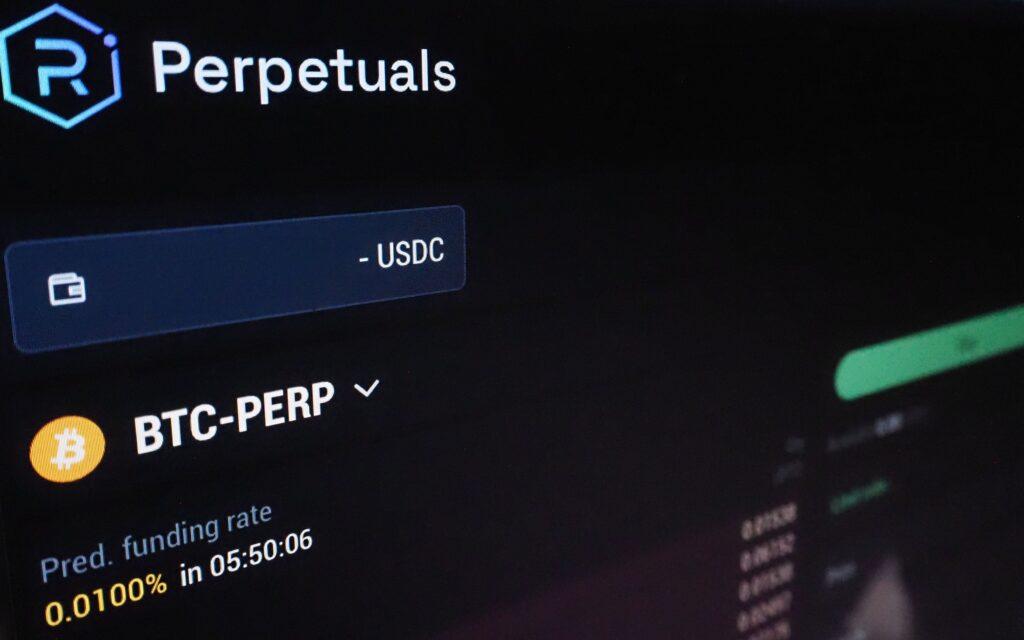

Decentralized Raydium of Crypto Trading Raydium is making an offer for the market for perpetual multimillionaires of Solana, and winning rapidly.

Raydium’s foray to offer these hipperpopular derivative contracts (allow specular cryptography merchants about price changes without maintaining the real token, it is already accumulating $ 100 million in daily negotiation volume.

Now is the third most popular place in Solana to trade Perse, behind Jupiter and Drift, the commercial weights of this ecosystem. Growth occurs despite the nascence of Raydium PERS; Its builders have not poured marketing capital to promote a negotiation tool that has still been officially launched.

“Raydium Brand still has a great impact,” said Infraray, a central collaborator of the project.

The Push Caps Raydium ascendense to the top of the decentralized landscape of Crypto Trading from Solana. Its automated market manufacturer (AMM) configuration, which allows any person to turn a negotiation group of any asset, has been a manufacturer of difference in the memecoin of Solana era.

And yet, most merchants who use Raydium’s Swap Rails never visit their website. Instead, they access their services through commercial aggregators that divide orders into multiple places. This potentially means less activity for Raydium and, crucially, a weaker relationship with direct users, merchants.

In the language of the industry, these merchants are the “makers”, which execute a trade. The manufacturers, meanwhile, are those that provide liquidity, perhaps channeling active to Raydium AMM.

“Raydium has gone well on the manufacturer’s side,” said Infraray, “but there are greater effects of the network when he has the relationship with the policyholder.”

Behind the scene, Raydium’s Perse trade is being backed by Orderly Network, a negotiation project with roots outside the Solana ecosystem. Orderly allows Persses merchants who work from multiple blockchains to exchange assets in a unified orders book. This provides a softer candle for all orders.

Raydium’s deployment of a month from Orderly is proven to be a great blessing. Persses merchants in Solana now drive 25 percent of the total volume of Orderly.

“We are operating between $ 200 and $ 400 million per day in volumes” in the dozen couple of projects that offer trade in ordered support perps, said CEO RAN YI.

Facilitate operations through Orderly, instead of executing perps transactions in the chain, as many of Raydium’s most entrenched competitors do, they can save money to the protocol and better guarantee the transactions process, said Infraray. But it also comes with its own cross -chain complexities that, according to him, are still working.

Next stop: complete launch. In a few weeks, Raydium’s Perse service will be ready for adequate debut and shake the “public beta” training wheels. Once it does, the teams behind this plan to press marketing and dissemination more.

Even at $ 100 million in daily volumes, Raydium’s Perses service is far from displacing the Perses service of the chain chain of the Solana Defi Ecosystem, Jupiter. The exchange of derivatives of the best -known swaps aggregator sees almost $ 2 billion in daily volume; The runner -up, Drift, sees twice the volume of Raydium.

But Infraray is confident that Raydium can protect the respective cables from the largest protocols. On the one hand, its Perps service offers much more active operations than any of the competitors. Orderly allows rapid listings of new contracts, which means that Raydium can move quickly to capture, and potentially corner, new markets.

He believes that the total directionable market for sops based in Solana will only grow.

“I hope there is more competition and innovation. But Raydium currently has a seat on the table.”